Understanding scrap value is essential for anyone managing assets, investments, or depreciation schedules. Scrap value represents the residual worth of an asset at the end of its useful life. Companies use this concept in financial reporting, tax calculations, and capital budgeting. In this guide, I will break down what scrap value means, how to calculate it, and why it matters in financial decision-making.

Table of Contents

What is Scrap Value?

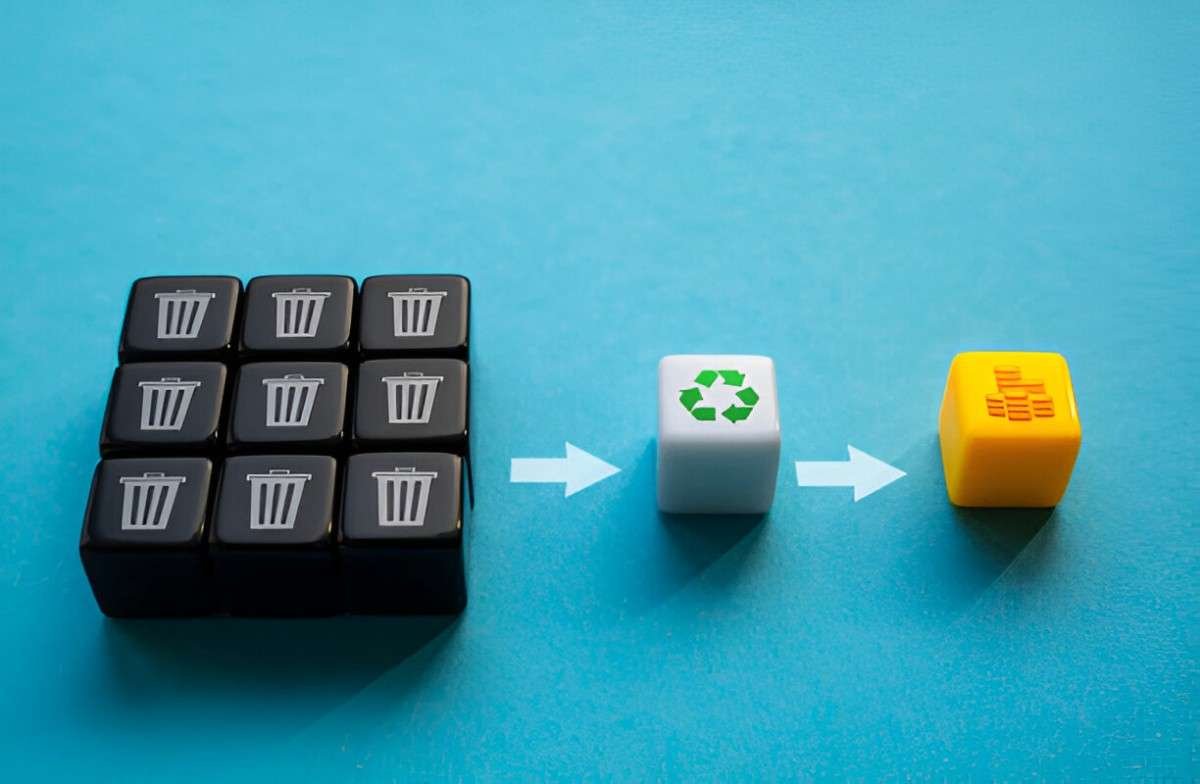

Scrap value, also called salvage value, refers to the estimated worth of an asset when it can no longer serve its intended purpose. Businesses consider this value when calculating depreciation, determining asset disposal strategies, or planning equipment replacements.

Key Factors Affecting Scrap Value

- Material Composition: Assets made of valuable metals like gold or copper retain higher scrap value.

- Market Conditions: Demand for scrap materials affects pricing.

- Wear and Tear: Heavily used assets tend to have lower scrap value.

- Obsolescence: Technological advancements can reduce an asset’s resale potential.

- Regulations: Environmental policies may affect disposal costs and resale opportunities.

How to Calculate Scrap Value

Scrap value calculations depend on asset type and industry standards. There are two primary methods:

- Percentage of Original Cost – Many businesses estimate scrap value as a percentage of the initial purchase price.

- Market-Based Approach – The value is determined by assessing current resale and scrap market trends.

Example: Scrap Value as a Percentage of Original Cost

Assume a company purchases machinery for $100,000. If the estimated scrap value is 10% of the purchase price, the calculation is:

This means the company expects to recover $10,000 when disposing of the asset.

Example: Market-Based Scrap Value

If a company evaluates the resale market and determines similar machines sell for $8,500 at the end of their life, the scrap value is set at $8,500 instead of a fixed percentage.

Scrap Value and Depreciation

Scrap value plays a critical role in calculating depreciation. The depreciation formula adjusts the initial cost by subtracting the scrap value before spreading the cost over the asset’s useful life.

Straight-Line Depreciation Method

The straight-line method is one of the simplest ways to calculate depreciation:

Example Calculation

A company buys a delivery truck for $50,000, expects it to last 10 years, and estimates a scrap value of $5,000. The annual depreciation is:

Each year, the company reduces the truck’s book value by $4,500 until it reaches the scrap value of $5,000.

Scrap Value in Asset Disposal Decisions

Businesses must decide whether to sell, repurpose, or scrap assets. Scrap value helps companies assess the financial impact of disposal choices.

Comparison of Disposal Methods

| Disposal Method | Description | Financial Impact |

|---|---|---|

| Sell as Used Equipment | Resell to another company | May yield a higher return than scrap value |

| Trade-In | Exchange for a discount on new equipment | Reduces capital expenditure |

| Scrap | Sell materials for recycling | Generates immediate but lower cash inflow |

| Donate | Give to a nonprofit for a tax benefit | Possible tax deduction |

Tax Implications of Scrap Value

Scrap value impacts tax depreciation schedules. The IRS requires businesses to estimate an asset’s residual value when calculating depreciation for tax deductions.

MACRS and Scrap Value

The Modified Accelerated Cost Recovery System (MACRS) is the most common depreciation method for tax purposes in the U.S. Under MACRS, businesses often assume a zero scrap value for tax reporting, allowing for full depreciation.

Scrap Value in Capital Budgeting

Companies evaluating new investments consider scrap value in net present value (NPV) and internal rate of return (IRR) calculations.

Net Present Value Formula

The formula for NPV, incorporating scrap value, is:

Where:

- = cash inflow in period

- = discount rate

- = scrap value

- = asset life in years

- = initial investment

Example NPV Calculation Including Scrap Value

Assume a company invests $100,000 in equipment generating annual cash flows of $30,000 for 5 years, with a 10% discount rate and a $10,000 scrap value.

NPV Calculation:

Computing the discounted values:

Summing these present values gives the total NPV, helping businesses decide whether to invest in the asset.

Scrap Value in Personal Finance

Individuals also encounter scrap value when dealing with cars, home appliances, or electronics. Knowing the expected residual value can help plan for replacements.

Example: Selling a Used Car

A person buys a car for $25,000 and expects to sell it for $5,000 after 8 years. The annual depreciation using the straight-line method is:

This estimate helps in budgeting for a future vehicle purchase.

Conclusion

Scrap value is a fundamental concept in finance, influencing depreciation, tax planning, capital budgeting, and asset disposal. Understanding how to calculate and apply scrap value ensures better financial planning and investment decisions. Whether managing corporate assets or personal finances, recognizing an asset’s residual worth helps optimize financial strategies and maximize value over time.