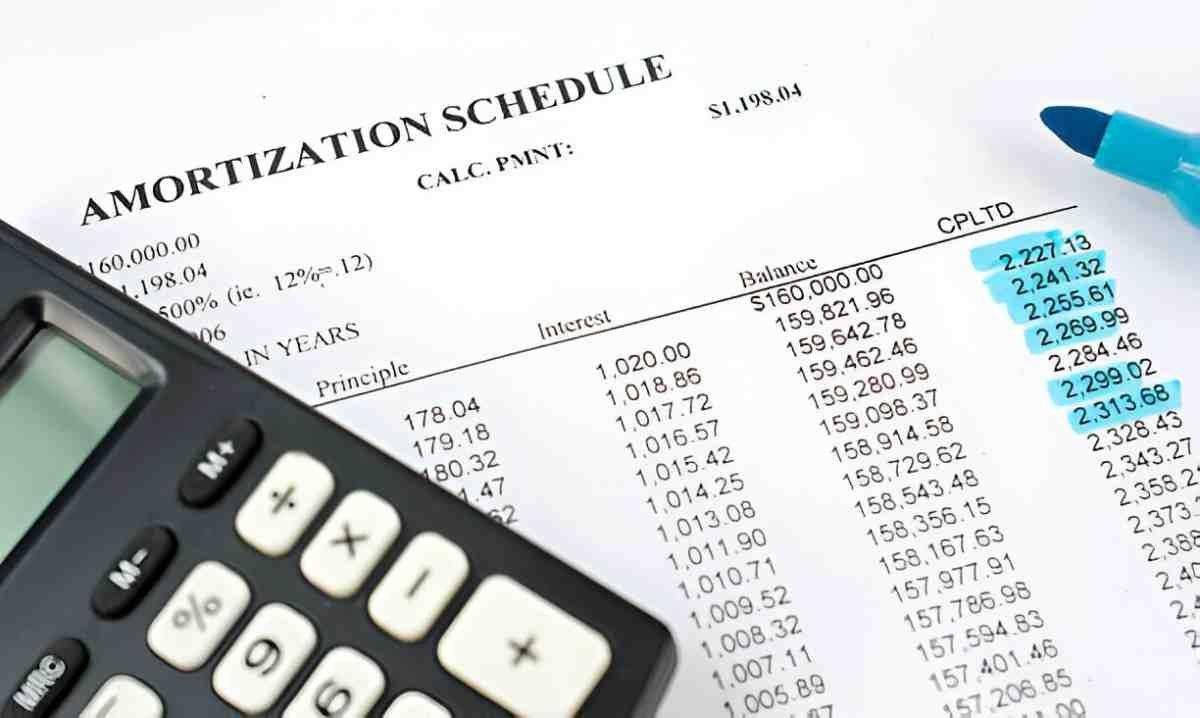

An amortization schedule is a table or chart that outlines the periodic payments, principal repayment, interest allocation, and remaining balance for a loan or mortgage over its term. This schedule helps borrowers and lenders understand how payments are applied towards reducing the loan balance over time.

Table of Contents

Key Features of an Amortization Schedule

1. Purpose and Importance

- Payment Breakdown: It details each payment’s allocation between principal and interest, providing clarity on the loan’s amortization process.

- Financial Planning: Helps borrowers plan their finances by predicting future payments and understanding the impact on their budget.

- Transparency: Offers transparency in loan terms and conditions, ensuring both parties understand the repayment structure.

2. Components of an Amortization Schedule

- Payment Number: Sequential number assigned to each payment.

- Payment Date: Date when the payment is due.

- Principal Payment: Amount applied to reduce the loan balance.

- Interest Payment: Portion of the payment allocated to interest charges.

- Total Payment: Sum of principal and interest for each installment.

- Remaining Balance: Outstanding loan amount after each payment.

3. Calculation Methodology

- Fixed Payments: For loans with fixed-rate amortization, each installment is consistent, but the allocation between principal and interest changes over time.

- Interest Calculation: Typically computed using the remaining principal balance and the loan’s interest rate.

- Principal Reduction: As payments are made, more of each subsequent payment goes towards reducing the principal.

Example Scenario

Consider a $100,000 mortgage with a 30-year term and a fixed annual interest rate of 4.5%. Here’s how an amortization schedule might look:

- Payment 1: Initial monthly payment of $506.69.

- Interest: $375.00

- Principal: $131.69

- Remaining Balance: $99,868.31

- Payment 12: After one year, payment of $506.69.

- Interest: $370.03

- Principal: $136.66

- Remaining Balance: $99,715.57

- Payment 360: Final payment.

- Interest: Minimal

- Principal: Pays off the remaining balance.

Benefits and Considerations

4. Benefits of Using an Amortization Schedule

- Visualization: Clear visualization of payment structure and progress towards debt repayment.

- Financial Planning: Helps borrowers budget effectively by forecasting future payments.

- Comparison Tool: Facilitates comparison between different loan options based on total interest paid and repayment timelines.

5. Considerations

- Interest Impact: Early payments are heavily interest-weighted; later payments increasingly reduce the principal.

- Loan Modifications: Changes in loan terms or extra payments may alter the amortization schedule.

- Tax Implications: Mortgage interest payments may have tax implications depending on local regulations.

Application in Real Life

Amortization schedules are widely used in various loan types, including mortgages, car loans, and personal loans. They play a crucial role in financial planning for individuals and businesses, providing a structured approach to debt repayment.

Conclusion

Understanding an amortization schedule is essential for anyone entering into a loan agreement. It offers transparency and clarity regarding the repayment process, helping borrowers make informed financial decisions. By following the schedule, borrowers can manage their debts effectively and plan for future financial obligations.

Reference

For further details on amortization schedules, refer to financial literacy resources, loan agreements, and online calculators that demonstrate how payments are distributed over time. Additionally, seek advice from financial professionals to understand specific implications for your financial situation.