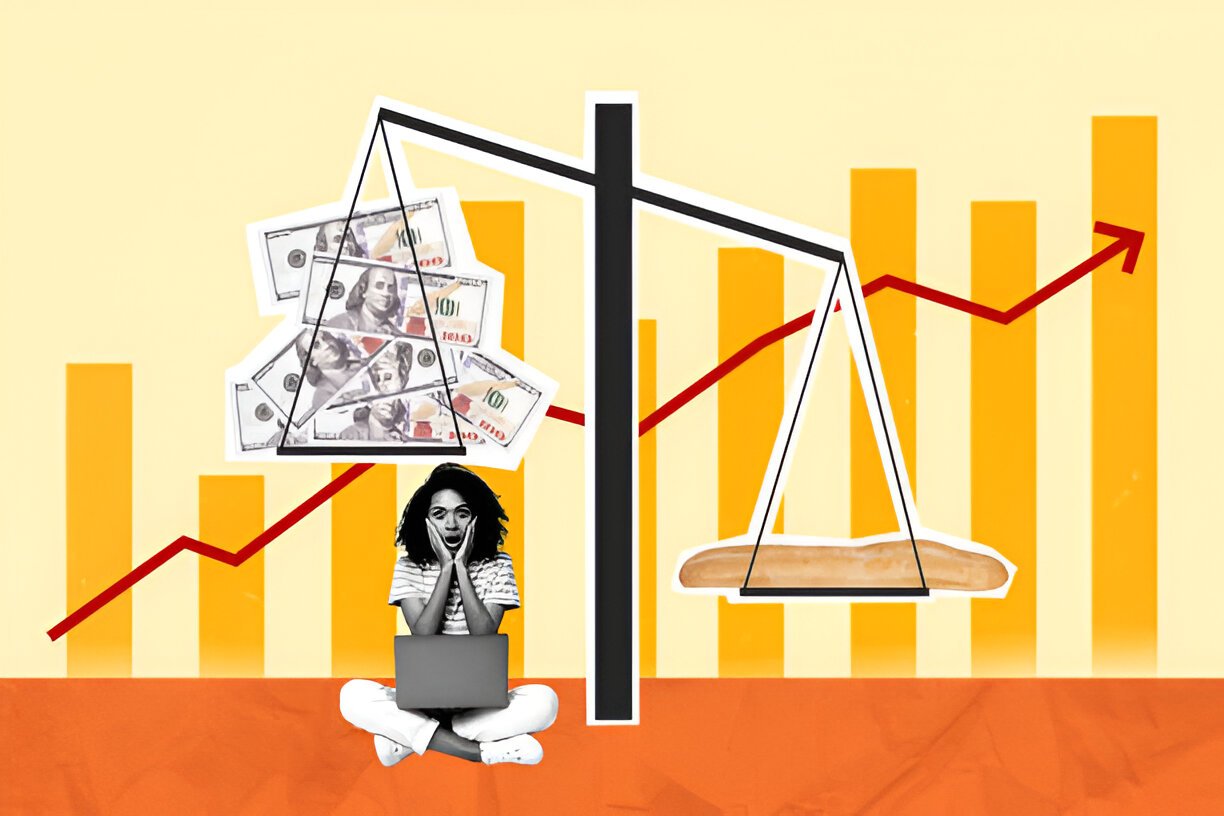

In the complex world of corporate finance, firms are constantly managing risks to stay afloat and maximize their value. One significant aspect of financial management is understanding the potential costs associated with financial distress. The “Cost of Financial Distress” theory is a crucial framework that helps us understand how financial difficulties can impact a company’s performance and valuation. As I explore this theory, I’ll walk you through its core concepts, implications, and real-world applications, with examples and calculations to provide a practical understanding.

Table of Contents

What is the Cost of Financial Distress?

Financial distress refers to a situation where a company is struggling to meet its debt obligations or is at risk of insolvency. When a firm faces financial distress, the costs incurred can be both direct and indirect. Direct costs are easily quantifiable, such as legal fees, bankruptcy proceedings, and restructuring costs. Indirect costs, on the other hand, are less obvious but often more impactful, such as loss of customers, reduced employee morale, or difficulty accessing new capital.

I’ve learned that understanding these costs is crucial because they affect a company’s decision-making process. The theory of financial distress costs suggests that as a firm’s debt levels increase, the probability of experiencing financial distress also rises, leading to higher associated costs. This can result in a decline in the firm’s value and, ultimately, shareholder wealth.

The Two Types of Costs: Direct and Indirect

To fully grasp the implications of financial distress, it’s important to differentiate between direct and indirect costs.

Direct Costs: These costs are tangible and quantifiable. The most obvious direct costs include:

- Legal and administrative fees: During financial distress, companies often incur significant expenses related to legal proceedings, including bankruptcy filings and consultations with financial advisors.

- Bankruptcy costs: These are the fees associated with formal bankruptcy procedures. It can also include the costs of restructuring, creditor negotiations, and asset liquidation.

- Debt restructuring: When firms are unable to meet their obligations, restructuring their debt can be costly. They may need to negotiate terms with creditors, which can involve legal and advisory fees.

Indirect Costs: While indirect costs are harder to quantify, they can have a profound impact on the company’s long-term viability. These include:

- Loss of customers: If suppliers, customers, or clients sense financial instability, they may seek more reliable partners, leading to a reduction in business.

- Loss of employee morale: A firm in financial distress may experience lower employee morale, leading to higher turnover and a decrease in productivity.

- Decline in firm reputation: A company facing financial difficulty may suffer from a tarnished reputation, making it harder to raise capital in the future or secure new business relationships.

- Restricted access to capital: Financial distress often limits a firm’s ability to access new financing. Investors and lenders may demand higher interest rates or offer less favorable terms due to the perceived risk.

The Trade-Off Theory and the Optimal Capital Structure

One of the central discussions in the theory of financial distress is the trade-off between the benefits of debt and the costs associated with financial distress. The Trade-Off Theory of capital structure proposes that companies aim to find an optimal balance between debt and equity financing. Too little debt means a firm is not maximizing its tax shield benefits, while too much debt increases the likelihood of financial distress costs.

Let’s illustrate this with an example:

Example: Imagine Company A is considering whether to finance a new project with 100% equity or a mix of debt and equity. The company forecasts a tax shield benefit of $500,000 if it takes on debt, but the costs of financial distress in the event of failure would be $200,000.

- Scenario 1: All equity financing

No debt means no tax shield benefit. However, the company avoids any distress costs.

Net benefit: $0 - Scenario 2: Debt financing

The company finances the project with 50% debt. It receives a tax shield benefit of $500,000 but is at risk of incurring $200,000 in distress costs.

Net benefit: $500,000 (tax shield) – $200,000 (distress costs) = $300,000

From this scenario, we see how debt financing can benefit the company by providing tax shields, but it also brings with it the risk of distress costs. Companies need to balance these trade-offs when determining their capital structure.

Financial Distress and Firm Valuation

I often find that the cost of financial distress plays a significant role in determining a firm’s valuation. As the likelihood of distress increases, the firm’s value decreases. Investors factor in these risks when determining the market value of a company’s stock or debt. The cost of financial distress is, therefore, an essential consideration in corporate decision-making.

To illustrate this, consider the following example:

Example: Let’s assume two companies, X and Y, are similar in every way except for their capital structure. Company X has a debt-to-equity ratio of 0.5, while Company Y’s ratio is 2.0. Company Y is at a higher risk of financial distress due to its greater leverage, and investors would likely value it lower than Company X to account for this increased risk. The higher the potential for distress costs, the lower the firm’s market value, all else being equal.

The Pecking Order Theory: Another Perspective

The Pecking Order Theory offers a different perspective on financial distress. According to this theory, firms prioritize financing sources based on their cost and availability. Firms prefer to use internal funds first, followed by debt, and only resort to equity as a last resort. The reason for this hierarchy is the avoidance of the costs of financial distress.

If a company’s management believes that issuing debt could put them at risk of financial distress, they may choose to issue equity instead. This avoidance of debt helps keep the company’s debt levels manageable, reducing the probability of distress costs.

Factors Influencing Financial Distress Costs

Several factors can influence the severity of financial distress costs. These include:

- Industry characteristics: Certain industries, such as technology or startups, face higher uncertainty, which can increase the likelihood of financial distress. Firms in these industries are more likely to face higher distress costs.

- Firm size: Smaller firms may find it more difficult to access capital during times of financial difficulty, leading to higher distress costs.

- Debt structure: The terms of a firm’s debt can also play a significant role. Short-term debt is more likely to lead to financial distress compared to long-term debt because the company must make more frequent payments.

- Market conditions: In times of economic downturn, the likelihood of financial distress increases across industries. During recessions, firms may struggle to generate revenue, making it harder to meet debt obligations.

The Real-World Application of Financial Distress Theory

The theory of financial distress has practical applications for both managers and investors. For managers, understanding these costs is essential when making strategic decisions about financing and capital structure. Firms can avoid financial distress by maintaining a conservative approach to debt and ensuring they have a contingency plan in place. For investors, understanding the cost of financial distress allows them to assess the risks associated with investing in a particular firm. This can influence their decision to buy or sell stock, or their choice to lend money to a company.

I often see that companies with lower debt levels tend to weather financial crises better. For example, during the 2008 financial crisis, many highly leveraged firms faced severe financial distress, while firms with lower leverage fared better. The lesson here is that having too much debt can expose a firm to significant risk during times of financial difficulty.

Conclusion

In conclusion, the Cost of Financial Distress theory is a critical framework for understanding how financial difficulties impact a company. By examining both direct and indirect costs, the theory helps businesses and investors make more informed decisions regarding capital structure and financing. The trade-off between the benefits of debt and the costs of financial distress is central to this theory, and understanding this balance is crucial for achieving long-term financial stability.

The key takeaway is that while debt can offer valuable benefits like tax shields, it also carries significant risks, especially during economic downturns or periods of financial instability. Firms must carefully manage their debt levels and be prepared for the potential costs of financial distress. Through this approach, businesses can mitigate risk, maintain stability, and optimize their capital structure for long-term success.