Fixed spot transactions refer to agreements where a buyer and seller agree on a specific price for a commodity or financial instrument at the current market spot price, with delivery and payment occurring immediately or within a short period. In financial markets, fixed spot transactions are prevalent in commodities, currencies, and other assets where immediate settlement is required.

Table of Contents

Key Features of Fixed Spot Transactions

- Immediate Settlement: The transaction involves immediate or very prompt delivery of the asset and payment at an agreed-upon price.

- Current Market Price: The price is typically based on the spot price prevailing at the time of the transaction.

- Standardized Contracts: Often, fixed spot transactions follow standardized contracts or agreements to ensure clarity and enforceability.

How Do Fixed Spot Transactions Work?

Process of Fixed Spot Transactions

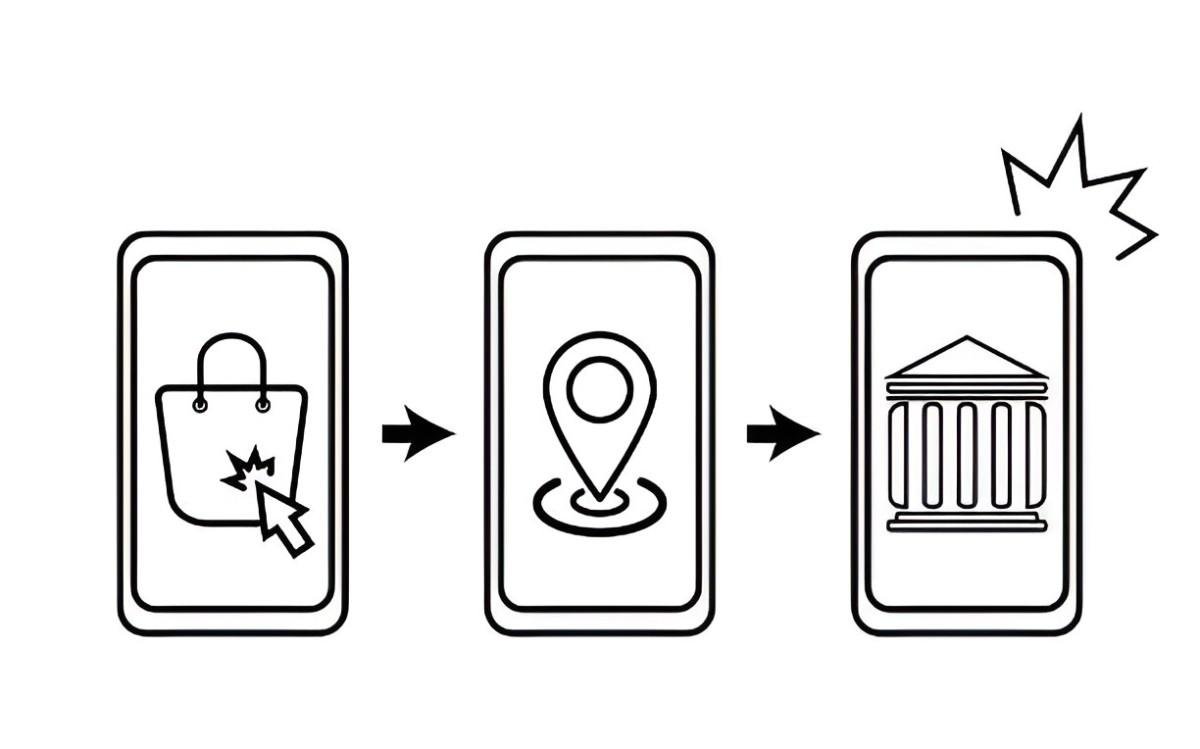

- Negotiation: The buyer and seller negotiate and agree on the price of the asset based on the current spot price in the market.

- Execution: The transaction is executed promptly, with both parties committing to deliver the asset and make payment according to the agreed terms.

- Settlement: Payment and delivery are settled either immediately (on the spot) or within a short period, typically within a few days.

Example of Fixed Spot Transaction

Currency Exchange

Imagine a company in the United States needs to purchase 100,000 euros immediately to settle an import payment. The current spot exchange rate is 1 euro = 1.10 US dollars. The company enters into a fixed spot transaction with a bank to buy euros at this rate for immediate delivery.

- Agreed Exchange Rate: 1 euro = 1.10 US dollars

- Transaction Amount: 100,000 euros

- Payment and Delivery: The company pays $110,000 to the bank and receives 100,000 euros immediately.

Importance of Fixed Spot Transactions

For Businesses

- Risk Management: Fixed spot transactions help businesses manage currency or commodity price fluctuations by locking in a known price.

- Immediate Needs: They cater to urgent requirements where immediate settlement and delivery are essential.

For Financial Markets

- Market Liquidity: Fixed spot transactions contribute to market liquidity by facilitating immediate exchanges of assets at current prices.

- Price Discovery: They help establish current market prices for assets based on supply and demand dynamics.

Comparison with Other Transaction Types

Fixed Spot vs. Futures Contracts

- Timeframe: Fixed spot transactions settle immediately or very shortly after the agreement, while futures contracts settle at a future date.

- Flexibility: Fixed spot transactions offer less flexibility in terms of delivery dates and terms compared to futures contracts.

Fixed Spot vs. Forward Contracts

- Delivery Date: Fixed spot transactions involve immediate delivery, whereas forward contracts set a future delivery date.

- Risk Exposure: Forward contracts may expose parties to counterparty risk over the contract period, which is mitigated in fixed spot transactions.

Regulatory Considerations

Compliance and Oversight

- Market Regulations: Financial regulators oversee fixed spot transactions to ensure fairness, transparency, and compliance with market rules.

- Reporting Requirements: Parties involved in fixed spot transactions may need to report details to regulatory authorities for transparency and oversight.

Conclusion

Fixed spot transactions are vital in financial markets and commodities trading, offering immediate settlement and price certainty based on current market conditions. They provide businesses with flexibility to manage immediate transactional needs and mitigate price risks associated with currency fluctuations or commodity price volatility. Understanding how fixed spot transactions work is crucial for businesses and investors seeking efficient and timely asset exchanges in global markets. By utilizing fixed spot transactions appropriately, stakeholders can enhance financial planning, manage risks effectively, and facilitate smoother operational processes in various sectors of the economy.