As a finance expert, I often get questions about how mutual fund income gets taxed. Many investors focus on returns but overlook the tax implications. The IRS has specific rules on what counts as taxable income from mutual funds. Some types of income get special treatment, and others get excluded entirely. In this guide, I break down the key exclusions and how they impact your tax bill.

Table of Contents

What Counts as Mutual Fund Income?

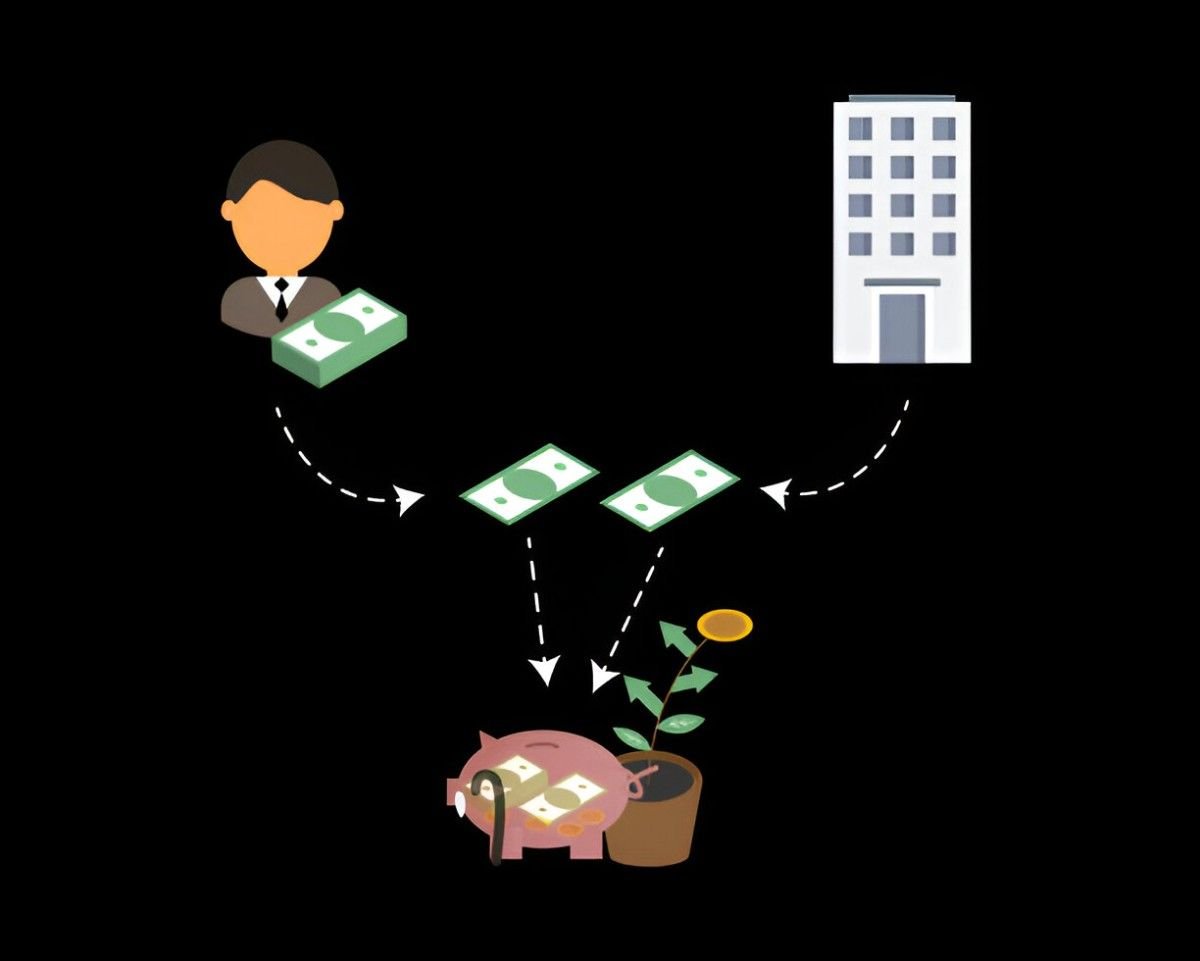

Mutual funds generate income in several ways:

- Dividends – Payments from stocks held within the fund.

- Interest – Earnings from bonds or cash equivalents.

- Capital Gains – Profits when the fund sells securities at a higher price.

But not all income gets taxed the same way. Some portions may be excluded or taxed at lower rates.

Common Exclusions from Mutual Fund Income

1. Tax-Exempt Municipal Bond Interest

Many mutual funds invest in municipal bonds (“munis”). The interest from these bonds is often exempt from federal income tax. If a fund holds munis, the tax-exempt portion gets passed to you.

Example:

- A fund earns $10,000 in municipal bond interest.

- You own 1% of the fund.

- Your share of tax-exempt income: 0.01 \times 10,000 = \$100.

This $100 won’t appear on your federal taxable income. However, some states may tax it if the bonds are from out-of-state.

2. Return of Capital (ROC) Distributions

Sometimes, mutual funds distribute money that isn’t profit. Instead, it’s a return of your original investment. These ROC distributions reduce your cost basis rather than triggering immediate taxes.

Example:

- You invest $10,000 in a fund.

- It distributes $1,000 as ROC.

- Your new cost basis: 10,000 - 1,000 = \$9,000.

- You only pay taxes when you sell the fund.

3. Foreign Tax Credits

If a mutual fund invests in foreign stocks, it may pay foreign taxes. The IRS allows you to claim a credit or deduction for these taxes to avoid double taxation.

Calculation:

- Fund pays $500 in foreign taxes.

- You own 2% of the fund.

- Your foreign tax credit: 0.02 \times 500 = \$10.

You can claim this credit on Form 1116.

4. Qualified Dividends

Not all dividends get taxed at the same rate. Qualified dividends get lower tax rates (0%, 15%, or 20%) compared to ordinary dividends (taxed at marginal rates).

Conditions for Qualified Dividends:

- Must be from U.S. or qualified foreign corporations.

- Held for more than 60 days during the 121-day period around the ex-dividend date.

Example:

- A fund distributes $5,000 in dividends.

- $3,000 are qualified.

- If you’re in the 22% tax bracket, you pay:

- Ordinary dividends: 2,000 \times 0.22 = \$440.

- Qualified dividends: 3,000 \times 0.15 = \$450.

- Total tax: 440 + 450 = \$890.

5. Capital Loss Carryforwards

If a mutual fund has net capital losses, it can carry them forward to offset future gains. These losses reduce taxable distributions.

Example:

- A fund has $50,000 in losses from prior years.

- This year, it realizes $60,000 in gains.

- Taxable gains: 60,000 - 50,000 = \$10,000.

Comparing Taxable vs. Tax-Exempt Mutual Fund Income

| Income Type | Taxable? | Special Treatment |

|---|---|---|

| Municipal Bond Interest | No (Federal) | State taxes may apply |

| Return of Capital | No | Reduces cost basis |

| Foreign Tax Credit | No | Credit/Deduction |

| Qualified Dividends | Yes (Lower Rate) | 0%, 15%, or 20% |

| Ordinary Dividends | Yes | Marginal tax rate |

| Short-Term Capital Gains | Yes | Ordinary income rates |

| Long-Term Capital Gains | Yes | 0%, 15%, or 20% |

How to Report Exclusions on Your Tax Return

- Form 1099-DIV – Shows dividends and capital gains distributions.

- Form 1099-INT – Reports interest income (including tax-exempt interest).

- Form 1116 – Used for foreign tax credits.

Key Takeaway: Always review your fund’s annual tax statement to identify exclusions.

Final Thoughts

Mutual fund taxation isn’t straightforward, but knowing the exclusions helps minimize your tax burden. Municipal bonds, ROC distributions, and foreign tax credits can reduce taxable income. Qualified dividends and long-term capital gains get preferential rates.

If you hold mutual funds in taxable accounts, consult a tax professional to optimize your strategy. Tax efficiency matters just as much as returns.