Introduction

Investors rely on different metrics to assess risk and return in financial markets. Two of the most fundamental concepts in this regard are alpha and beta. These measures help evaluate the performance of individual securities, mutual funds, and portfolios. While alpha measures excess returns over a benchmark, beta gauges volatility relative to the market. Understanding these concepts is crucial for making informed investment decisions.

Table of Contents

What Is Alpha?

Alpha represents the additional return an investment generates beyond its expected return based on its risk level. If an asset has an alpha of 2, it means it outperformed the market by 2%. Conversely, an alpha of -2 suggests underperformance. Portfolio managers aim for positive alpha, as it indicates their ability to add value through active management.

Formula for Alpha

\alpha = R_i - \left[ R_f + \beta (R_m - R_f) \right]Where:

- R_i = \text{Actual return of the investment}

- R_f = \text{Risk-free rate (e.g., U.S. Treasury bond yield)}

- \beta = \text{Beta of the investment}

- R_m = \text{Market return}

Example Calculation of Alpha

Assume a stock fund generated a return of 12%, the market returned 10%, and the risk-free rate was 2%. If the fund’s beta is 1.2, alpha can be calculated as follows:

\alpha = 12 - \left[ 2 + 1.2 (10 - 2) \right] = 12 - [2 + 9.6] = 12 - 11.6 = 0.4A positive alpha of 0.4% suggests the fund outperformed expectations.

What Is Beta?

Beta measures an asset’s sensitivity to market movements. A beta of 1 implies the asset moves in line with the market. A beta greater than 1 indicates higher volatility, while a beta below 1 suggests lower volatility.

Interpreting Beta

| Beta Value | Interpretation |

|---|---|

| <1<1 | Less volatile than the market |

| 1 | Moves in tandem with the market |

| >1>1 | More volatile than the market |

Formula for Beta

\beta = \frac{Cov(R_i, R_m)}{Var(R_m)}Where:

- Cov(R_i, R_m) = \text{Covariance between the asset and market returns}

- Var(R_m) = \text{Variance of market returns}

Example Calculation of Beta

Suppose a stock’s return has a covariance with the market of 0.025, and the market variance is 0.02. Then:

\beta = \frac{0.025}{0.02} = 1.25A beta of 1.25 suggests the stock is 25% more volatile than the market.

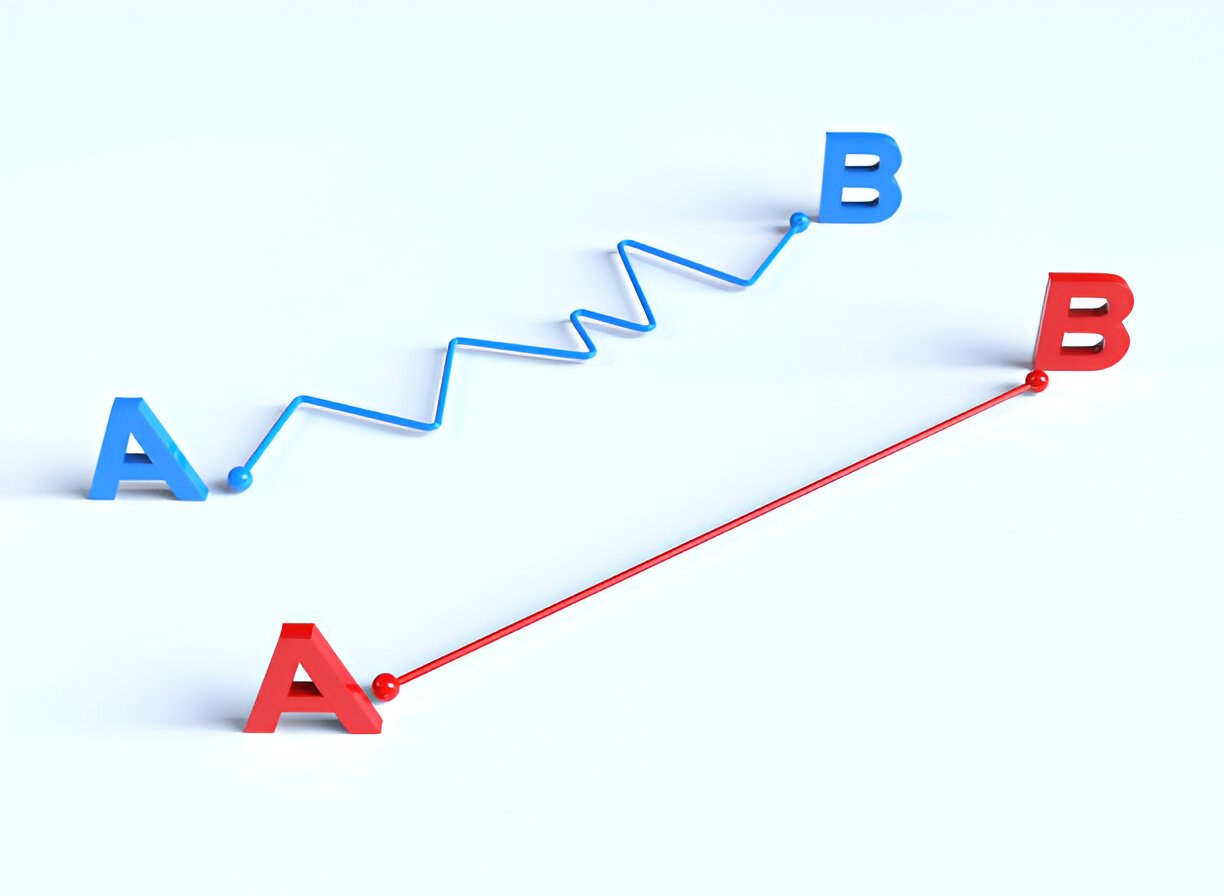

Comparing Alpha and Beta

| Factor | Alpha | Beta |

|---|---|---|

| Definition | Measures excess return over expected return | Measures volatility relative to the market |

| Ideal Value | Positive | Depends on risk tolerance |

| Role | Evaluates active management | Assesses systematic risk |

| Investor Preference | High alpha for better returns | Low beta for stability, high beta for growth |

Real-World Application of Alpha and Beta

- Passive vs. Active Investing: Index funds typically have a beta close to 1 and an alpha near zero. Actively managed funds seek high alpha, often accepting higher beta.

- Risk Management: Conservative investors may prefer low-beta stocks to minimize risk, while aggressive investors might target high-beta assets.

- Portfolio Diversification: Combining low-beta and high-beta assets can balance risk and return.

Limitations of Alpha and Beta

- Alpha can be misleading: High alpha does not guarantee consistent performance.

- Beta assumes linearity: Market movements are not always predictable.

- Both are backward-looking: They rely on historical data and may not predict future performance.

Conclusion

Alpha and beta are essential tools for understanding investment performance and risk. Alpha helps measure excess returns, while beta assesses volatility. Investors should consider both metrics to align investments with their risk tolerance and return expectations. A well-balanced approach that integrates alpha and beta can lead to more informed financial decisions.