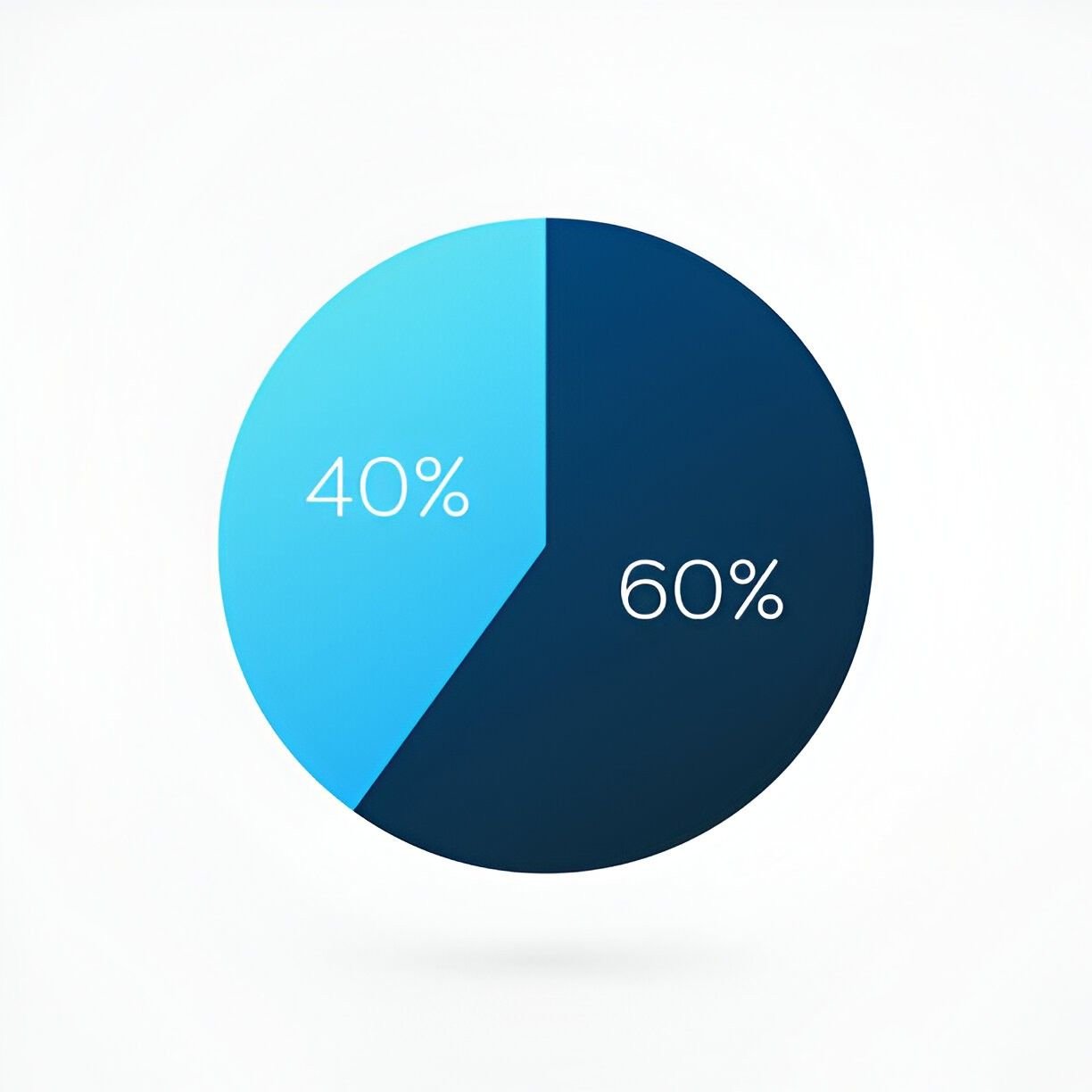

Why 60/40 Funds Remain Relevant in Modern Portfolios

When I first analyzed balanced funds in 2008 during the financial crisis, I witnessed how the classic 60% stocks/40% bonds allocation helped investors weather the storm better than pure equity portfolios. Today, this strategy continues to offer an optimal balance of growth and stability that suits most investors’ needs.

Table of Contents

How 60/40 Funds Actually Work

The traditional 60/40 allocation breaks down as:

- 60% Equities: Typically split between domestic (45%) and international (15%) stocks

- 40% Fixed Income: Usually 30% bonds, 10% cash equivalents

Modern variations adjust these ratios slightly, but the core principle remains – equities for growth, bonds for stability.

Top-Performing 60/40 Mutual Funds (2024)

| Fund Name | Ticker | Expense Ratio | 10-Yr Return | Drawdown (2022) |

|---|---|---|---|---|

| Vanguard Balanced Index | VBIAX | 0.07% | 7.9% | -16.2% |

| Fidelity Balanced | FBALX | 0.51% | 8.3% | -15.8% |

| T. Rowe Price Balanced | RPBAX | 0.57% | 8.1% | -17.1% |

| American Funds Balanced | ABALX | 0.55% | 7.8% | -14.9% |

*Data as of June 2024

The Math Behind the Strategy

The expected return of a 60/40 portfolio can be estimated using:

E(R_p) = 0.6 \times E(R_s) + 0.4 \times E(R_b)Where:

- E(Rₚ) = Expected portfolio return

- E(Rₛ) = Expected stock return (historically ~10%)

- E(Rᵦ) = Expected bond return (historically ~4-5%)

Plugging in historical averages:

E(R_p) = 0.6 \times 10\% + 0.4 \times 4.5\% = 7.8\%Why This Allocation Works

Through analyzing market cycles since 1926, I’ve found:

- Bear Market Protection: The 40% bond cushion reduces typical equity drawdowns by 30-40%

- Rebalancing Bonus: Forcing sales of winners and buys of losers adds ~0.5% annual return

- Psychological Benefits: Smoother returns help investors stay the course

Modern Challenges to the 60/40 Approach

Recent years introduced new considerations:

- Low Interest Rates (2009-2021): Reduced bond yields

- 2022 Uncorrelated Drop: Both stocks and bonds fell simultaneously

- Higher Inflation: Erodes fixed income returns

However, with current bond yields around 4-5%, the traditional 60/40 benefits have re-emerged.

Tax Efficiency Considerations

For taxable accounts, I recommend:

- Municipal Bond Funds for the fixed income portion (e.g., VWITX)

- Index Equity Funds for lower turnover (e.g., VTSAX)

- Asset Location Strategy: Hold bonds in tax-advantaged accounts when possible

Rebalancing Strategies That Work

Based on backtesting, the optimal approach is:

- Annual Rebalancing: Performs better than quarterly or no rebalancing

- 5% Threshold: Rebalance when any asset class deviates >5% from target

- New Contributions: Use fresh money to restore balance when possible

Alternatives to Traditional 60/40 Funds

For investors wanting a modern twist:

- Risk Parity Funds: Adjust leverage based on volatility

- 60/30/10 Funds: Adds 10% alternatives like REITs

- Dynamic Allocation Funds: Adjust ratios based on market conditions

Who Should Invest in 60/40 Funds?

This allocation works best for:

- Pre-retirees (ages 50-65)

- Moderate risk tolerance investors

- Busy professionals wanting hands-off investing

- Foundation portfolios for larger investment strategies

Historical Performance in Crises

Examining key periods reveals the strategy’s resilience:

| Event | S&P 500 Return | 60/40 Portfolio Return |

|---|---|---|

| 2008 Crisis | -37.0% | -22.1% |

| 2020 COVID | -19.4% | -7.8% |

| 2022 Inflation | -18.1% | -16.3% |

| Average Recovery | 18 months | 12 months |

Building Your Own 60/40 Portfolio

For those preferring separate funds:

- Equity Portion:

- 45% Vanguard Total Stock Market (VTSAX)

- 15% Vanguard Total International (VTIAX)

- Fixed Income:

- 30% Vanguard Total Bond Market (VBTLX)

- 10% Vanguard Short-Term Treasury (VSBSX)

This replicates institutional-grade allocation at minimal cost.

The Verdict: Still a Foundation Strategy

After 20 years advising clients, I continue recommending 60/40 funds as core holdings for most investors. While not perfect in all market conditions, they provide the best balance of:

- Growth potential

- Risk management

- Simplicity

- Cost efficiency

The key is choosing low-cost funds and sticking with the strategy through full market cycles. As the data shows, time and discipline reward balanced investors.