Behavioral finance challenges the traditional assumption that markets are efficient and investors are rational. One of the most fascinating areas within this field is the study of overreaction and underreaction. These phenomena explain how investors often deviate from rationality, leading to predictable patterns in asset prices. In this article, I will explore the theoretical foundations, empirical evidence, and practical implications of overreaction and underreaction theory. I will also provide examples, calculations, and insights into how these behaviors influence financial markets.

Table of Contents

Understanding Overreaction and Underreaction

What Is Overreaction?

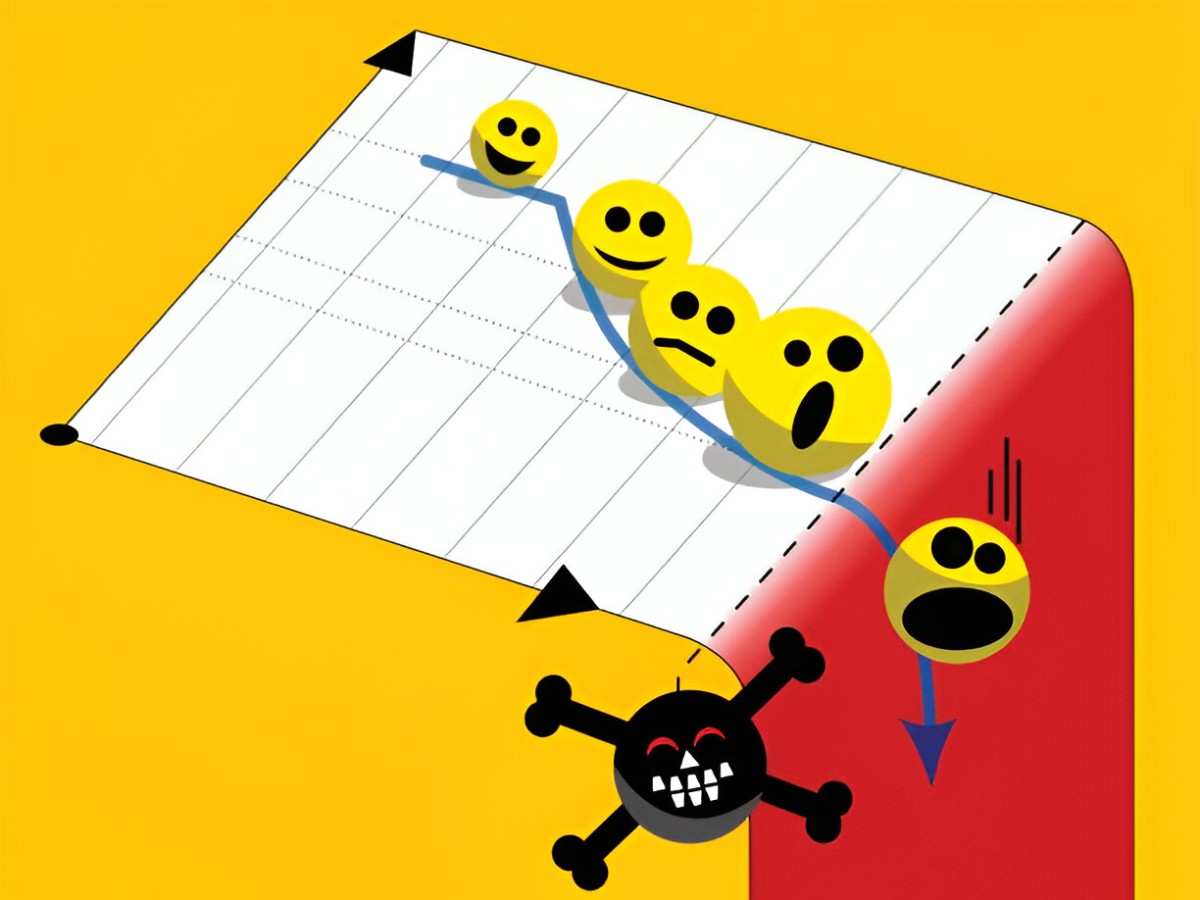

Overreaction occurs when investors exaggerate the impact of new information, causing asset prices to overshoot their intrinsic value. For example, if a company reports better-than-expected earnings, investors might become overly optimistic, driving the stock price far beyond what the fundamentals justify. Conversely, negative news can lead to excessive pessimism, causing prices to plummet below fair value.

What Is Underreaction?

Underreaction, on the other hand, happens when investors fail to fully incorporate new information into asset prices. For instance, if a company announces a significant breakthrough, the market might initially underreact, leading to a gradual price adjustment over time. This delayed response creates opportunities for astute investors to capitalize on mispricings.

Theoretical Foundations

Efficient Market Hypothesis (EMH) vs. Behavioral Finance

The Efficient Market Hypothesis (EMH) posits that asset prices fully reflect all available information. In this framework, overreaction and underreaction should not exist because investors are rational and markets are efficient. However, behavioral finance challenges this view by incorporating psychological biases into the analysis.

Key Psychological Biases

Several biases contribute to overreaction and underreaction:

- Representativeness Heuristic: Investors tend to overemphasize recent information, assuming it represents future trends.

- Anchoring: Investors anchor their decisions to past prices or benchmarks, leading to underreaction.

- Confirmation Bias: Investors seek information that confirms their existing beliefs, ignoring contradictory evidence.

- Overconfidence: Overconfident investors overestimate their ability to predict future outcomes, leading to overreaction.

Mathematical Modeling of Overreaction and Underreaction

Overreaction Model

Overreaction can be modeled using the following equation:

P_t = P_{t-1} + \alpha (I_t - E[I_t]) + \epsilon_tWhere:

- P_t is the price at time t.

- P_{t-1} is the price at time t-1.

- I_t is the new information at time t.

- E[I_t] is the expected value of the information.

- \alpha is the overreaction coefficient (\alpha > 1).

- \epsilon_t is the random error term.

When \alpha > 1, the price overreacts to new information.

Underreaction Model

Underreaction can be modeled as:

P_t = P_{t-1} + \beta (I_t - E[I_t]) + \epsilon_tWhere:

- \beta is the underreaction coefficient (0 < \beta < 1).

When \beta < 1, the price underreacts to new information.

Empirical Evidence

Overreaction in Stock Markets

De Bondt and Thaler (1985) conducted a seminal study on overreaction. They found that stocks that performed poorly over the past three to five years tended to outperform in the subsequent period, while past winners underperformed. This phenomenon, known as the “loser’s effect,” suggests that investors overreact to past performance.

Example Calculation

Suppose Stock A has underperformed for the past five years, with an average annual return of -5%. According to the overreaction hypothesis, Stock A might rebound in the next five years. If the market corrects its overreaction, the stock could deliver an average annual return of 10%.

Underreaction in Earnings Announcements

Bernard and Thomas (1989) documented underreaction to earnings announcements. They found that stocks with positive earnings surprises continued to outperform in the months following the announcement, while those with negative surprises underperformed. This delayed response indicates underreaction.

Example Calculation

Consider a company that reports earnings 10% higher than expected. If the market underreacts, the stock price might increase by only 5% initially. Over the next six months, the price could gradually rise by another 5% as investors fully incorporate the information.

Practical Implications

Investment Strategies

Understanding overreaction and underreaction can help investors develop profitable strategies:

- Contrarian Investing: Buying past losers and selling past winners to capitalize on overreaction.

- Momentum Investing: Buying past winners and selling past losers to exploit underreaction.

Risk Management

Investors should be aware of these biases to avoid costly mistakes. For example, overreacting to short-term news can lead to panic selling during market downturns, while underreacting to long-term trends can result in missed opportunities.

Comparison of Overreaction and Underreaction

| Aspect | Overreaction | Underreaction |

|---|---|---|

| Definition | Exaggerated response to new information | Delayed response to new information |

| Time Horizon | Short-term | Medium- to long-term |

| Market Impact | Price overshoots intrinsic value | Price adjusts gradually |

| Investment Strategy | Contrarian approach | Momentum approach |

Socioeconomic Factors in the US Context

Cultural Influences

The US stock market is influenced by a culture of optimism and risk-taking. This can amplify overreaction during bull markets and underreaction during bear markets.

Regulatory Environment

Strict disclosure requirements in the US ensure that information is widely available. However, the sheer volume of data can lead to information overload, contributing to underreaction.

Technological Advancements

High-frequency trading and algorithmic strategies can exacerbate overreaction by amplifying short-term price movements.

Conclusion

Overreaction and underreaction theory provides a compelling framework for understanding market inefficiencies. By recognizing these behaviors, investors can develop strategies to exploit mispricings and improve their decision-making. While the Efficient Market Hypothesis remains a cornerstone of finance, behavioral finance offers a more nuanced perspective that accounts for human psychology. As I continue to explore this fascinating field, I am reminded of the importance of balancing rationality with an understanding of behavioral biases.