A wage freeze is a term often surfaces in discussions about financial stability, especially in the workplace. It is a measure taken by organizations to control labor costs and manage their financial health during challenging economic times. In this article, we will break down the concept of a wage freeze, explain why it is implemented, outline its impact on individuals and businesses, and provide real-world examples in simple language for learners.

Table of Contents

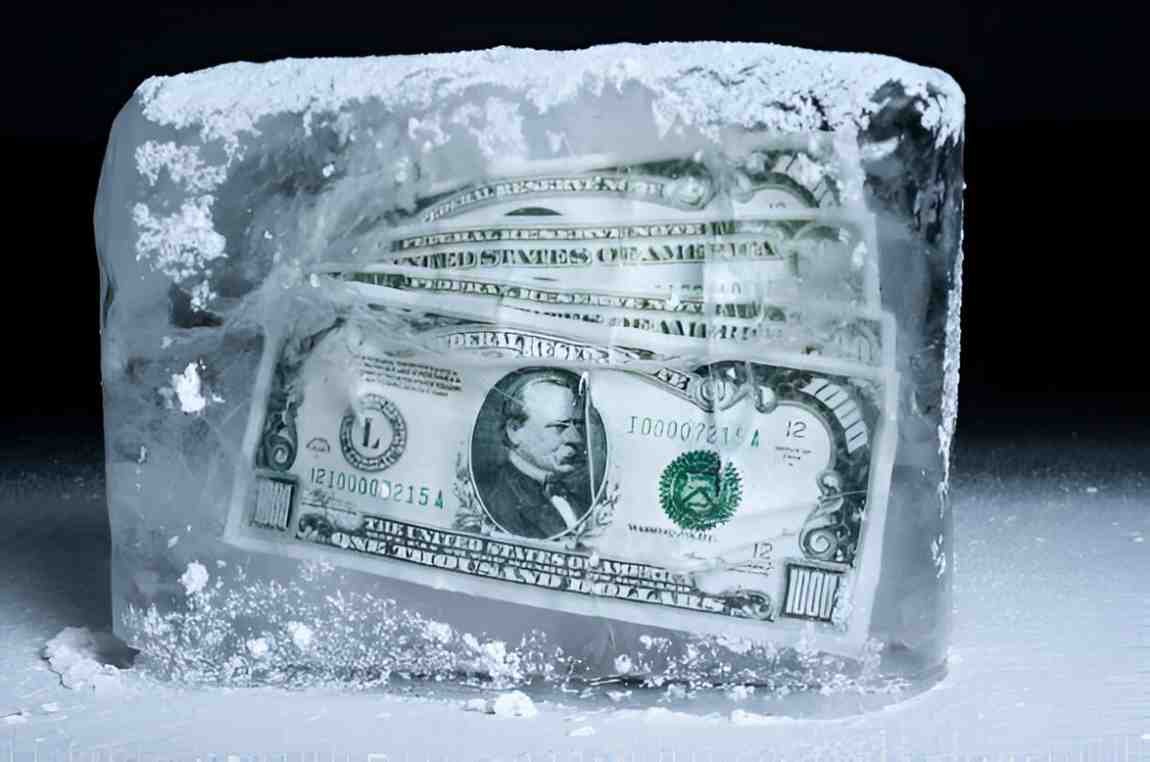

Defining Wage Freeze:

A wage freeze is a proactive decision made by an employer or organization to suspend, temporarily suspend or halt employee salary increases. Employees’ wages remain current during a wage freeze, and no raises or adjustments are granted, even if they were scheduled or expected.

Key Points about Wage Freezes:

- Temporary: Wage freezes are temporary measures to address short-term financial challenges or economic uncertainties.

- Salary Levels: Employees’ current salary levels are maintained, with no increases during the freeze period.

- Cost Control: Organizations use wage freezes to control labor costs and maintain financial stability.

- Impact on Benefits: A wage freeze may also affect other compensation elements, such as bonuses or retirement plan contributions, depending on the organization.

Significance in Finance and Employment:

Wage freezes have a significant impact on both financial and employment-related aspects:

1. Financial Stability: Organizations implement wage freezes to bolster their financial stability during periods of economic downturns, financial crises, or budget constraints.

2. Employee Morale: Wage freezes can affect employee morale and job satisfaction, as they may perceive it as a lack of recognition for their contributions.

3. Cost Management: Employers use wage freezes as a cost management tool to avoid layoffs and maintain a skilled workforce.

4. Labor Market Conditions: The prevalence of wage freezes can reflect the overall health of the labor market and the financial challenges businesses face.

Example:

To better understand the concept of a wage freeze, let’s consider a practical scenario involving a company named “TechPro Solutions.”

Scenario: Wage Freeze at TechPro Solutions

Reason for Wage Freeze: TechPro Solutions, an IT services company, faces a challenging economic environment due to a significant downturn in the technology sector. The company’s revenue and profits have declined, making it necessary to implement cost-saving measures.

Wage Freeze Implementation:

- Announcement: The company’s leadership announces a temporary employee wage freeze. They communicate that there will be no salary increases for the next fiscal year.

- Duration: The wage freeze lasts one year when employees’ salaries remain current.

Impact on Employees:

- Employees at TechPro Solutions will not receive the usual annual salary increases they had anticipated.

- Any performance-based bonuses or merit-based pay adjustments are also put on hold for the duration of the wage freeze.

Reasoning Behind the Wage Freeze:

- TechPro Solutions is implementing the wage freeze to control labor costs and navigate the challenging economic conditions without resorting to layoffs or downsizing.

Employee Reactions:

- Some employees may understand the necessity of the wage freeze as a way to safeguard their jobs and the company’s financial stability.

- Others may feel frustrated or dissatisfied, especially if they count on a salary increase to meet financial goals or address rising living costs.

Conclusion:

A wage freeze is a temporary measure organizations use to halt employee salary increases during challenging financial periods. It is a tool employed to control labor costs, maintain financial stability, and avoid layoffs. While it can help organizations weather economic storms, it may also impact employee morale and job satisfaction. Understanding wage freezes is essential for individuals and businesses alike, as they can have significant financial and employment-related implications.