Mutual funds are one of the most popular investment vehicles in the U.S., offering diversification, professional management, and accessibility. But how exactly do they function? In this guide, I’ll break down the mechanics of mutual funds, their advantages and disadvantages, and how they fit into a smart investment strategy.

Table of Contents

What Is a Mutual Fund?

A mutual fund is a pooled investment vehicle that collects money from multiple investors to buy a diversified portfolio of stocks, bonds, or other securities. Each investor owns shares of the fund, which represent a portion of the holdings.

Key Characteristics of Mutual Funds

- Pooled Investments – Money from many investors is combined.

- Professional Management – Fund managers make buy/sell decisions.

- Diversification – Reduces risk by spreading investments across assets.

- Liquidity – Investors can buy or sell shares at the fund’s Net Asset Value (NAV) at the end of each trading day.

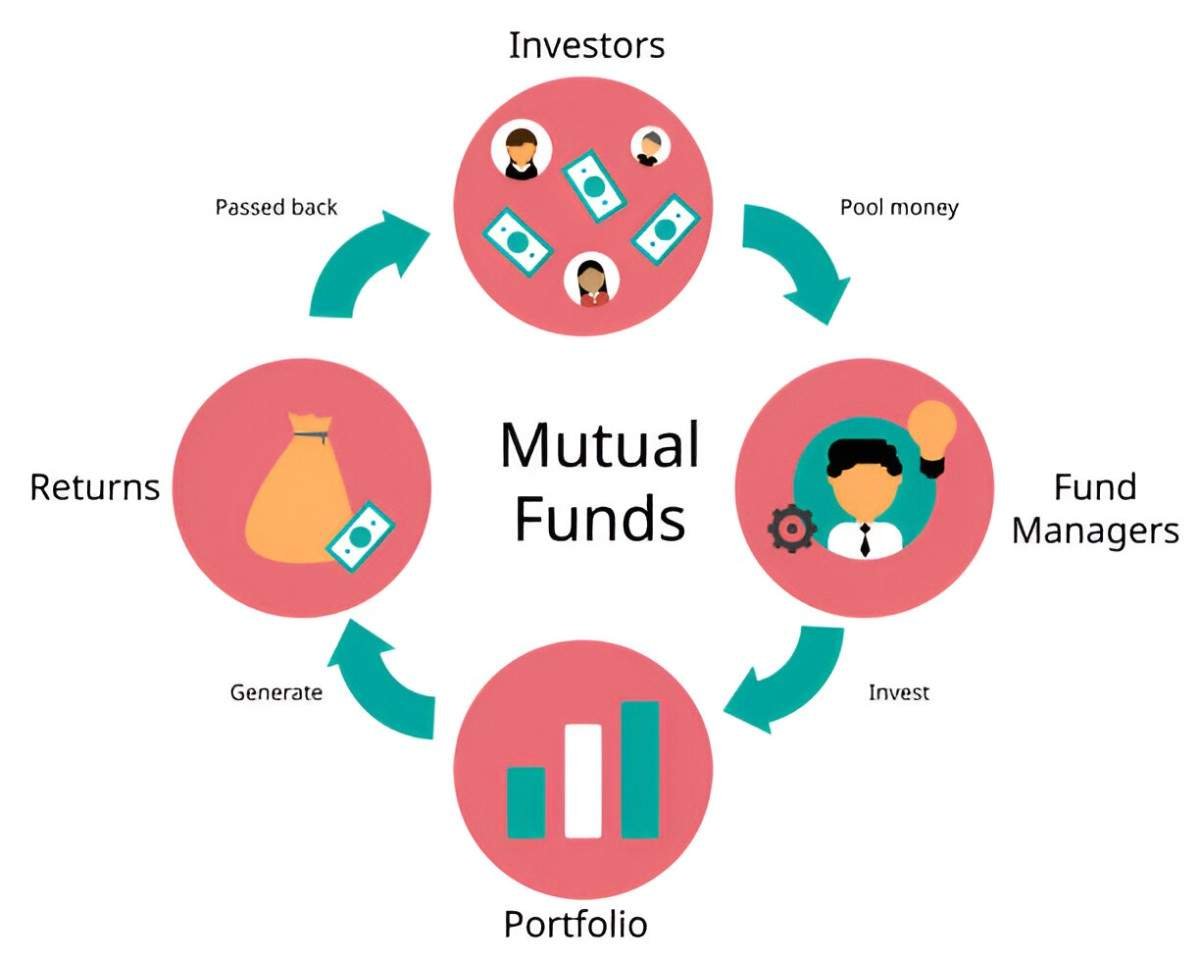

How Mutual Funds Operate: Step by Step

1. Investors Buy Shares

When you invest in a mutual fund, you purchase shares at the Net Asset Value (NAV), calculated daily after market close.

NAV = \frac{Total\ Assets - Total\ Liabilities}{Number\ of\ Outstanding\ Shares}Example:

- A fund has $100 million in assets, $5 million in liabilities, and 10 million shares.

- NAV = \frac{100M - 5M}{10M} = \$9.50\ per\ share

2. The Fund Manager Invests the Pooled Money

The fund manager allocates capital based on the fund’s strategy:

- Equity Funds → Stocks

- Bond Funds → Fixed-income securities

- Balanced Funds → Mix of stocks and bonds

3. Returns Are Generated

Investors earn returns through:

- Dividends/Interest – Paid out or reinvested.

- Capital Gains – Profits from selling securities.

4. Investors Redeem Shares

When you sell, the fund pays you the current NAV (minus fees, if applicable).

Types of Mutual Funds

| Type | Description | Risk Level | Avg. Returns |

|---|---|---|---|

| Index Funds | Tracks a market index (e.g., S&P 500) | Low-Medium | 7-10% |

| Actively Managed | Managers pick stocks to beat the market | Medium-High | Varies widely |

| Sector Funds | Focuses on one industry (e.g., tech) | High | Volatile |

| Bond Funds | Invests in government/corporate debt | Low-Medium | 3-6% |

| Money Market Funds | Ultra-safe, short-term debt | Very Low | 1-3% |

Pros and Cons of Mutual Funds

✅ Advantages

✔ Diversification – Reduces risk by spreading investments.

✔ Professional Management – Experts handle stock selection.

✔ Liquidity – Easy to buy/sell shares.

✔ Accessibility – Many funds have low minimum investments ($500-$3,000).

❌ Disadvantages

✖ Fees – Expense ratios (0.1%-2%) eat into returns.

✖ No Intraday Trading – Unlike ETFs, you can’t trade throughout the day.

✖ Capital Gains Taxes – Even if you don’t sell, you may owe taxes on fund distributions.

How Mutual Funds Compare to ETFs

| Feature | Mutual Funds | ETFs |

|---|---|---|

| Trading | End-of-day pricing (NAV) | Real-time (like stocks) |

| Fees | Often higher (actively managed) | Usually lower (passive) |

| Tax Efficiency | Less efficient (capital gains) | More efficient (in-kind redemptions) |

| Minimum Investment | Often $1K+ | As low as 1 share (~$50+) |

Are Mutual Funds Right for You?

Mutual funds are ideal if you:

✔ Want professional management.

✔ Prefer a hands-off, diversified approach.

✔ Don’t need intraday trading flexibility.

However, if you want lower fees, tax efficiency, and trading flexibility, ETFs might be a better choice.

Final Thoughts

Mutual funds simplify investing by offering instant diversification and expert management. While they come with fees and some limitations, they remain a solid choice for long-term investors.