Understanding Financial Behavior Through the Lens of Behavioral Theory

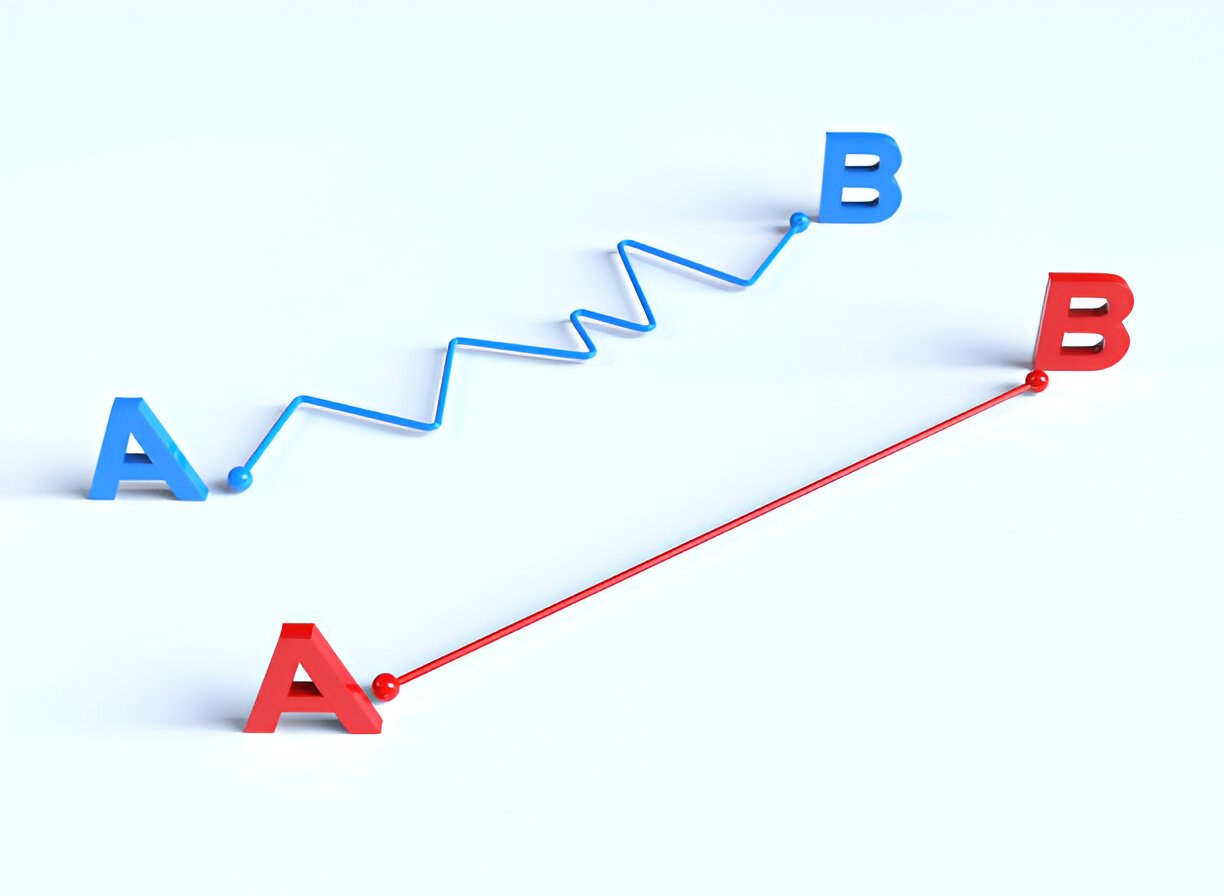

As someone who’s been involved in finance for many years, I’ve often wondered why people make certain financial decisions. I’ve seen it time and again: people behave irrationally with their money, even when they know better. To understand these behaviors, we can turn to behavioral theory, which helps explain the complex and often irrational ways […]

Understanding Financial Behavior Through the Lens of Behavioral Theory Read More »