As a finance expert, I often get asked about arbitrage mutual funds. Investors want to know whether these funds can deliver stable returns while managing risk. In this guide, I break down everything you need to know—how they work, their benefits, risks, and whether they fit your portfolio.

Table of Contents

What Are Arbitrage Mutual Funds?

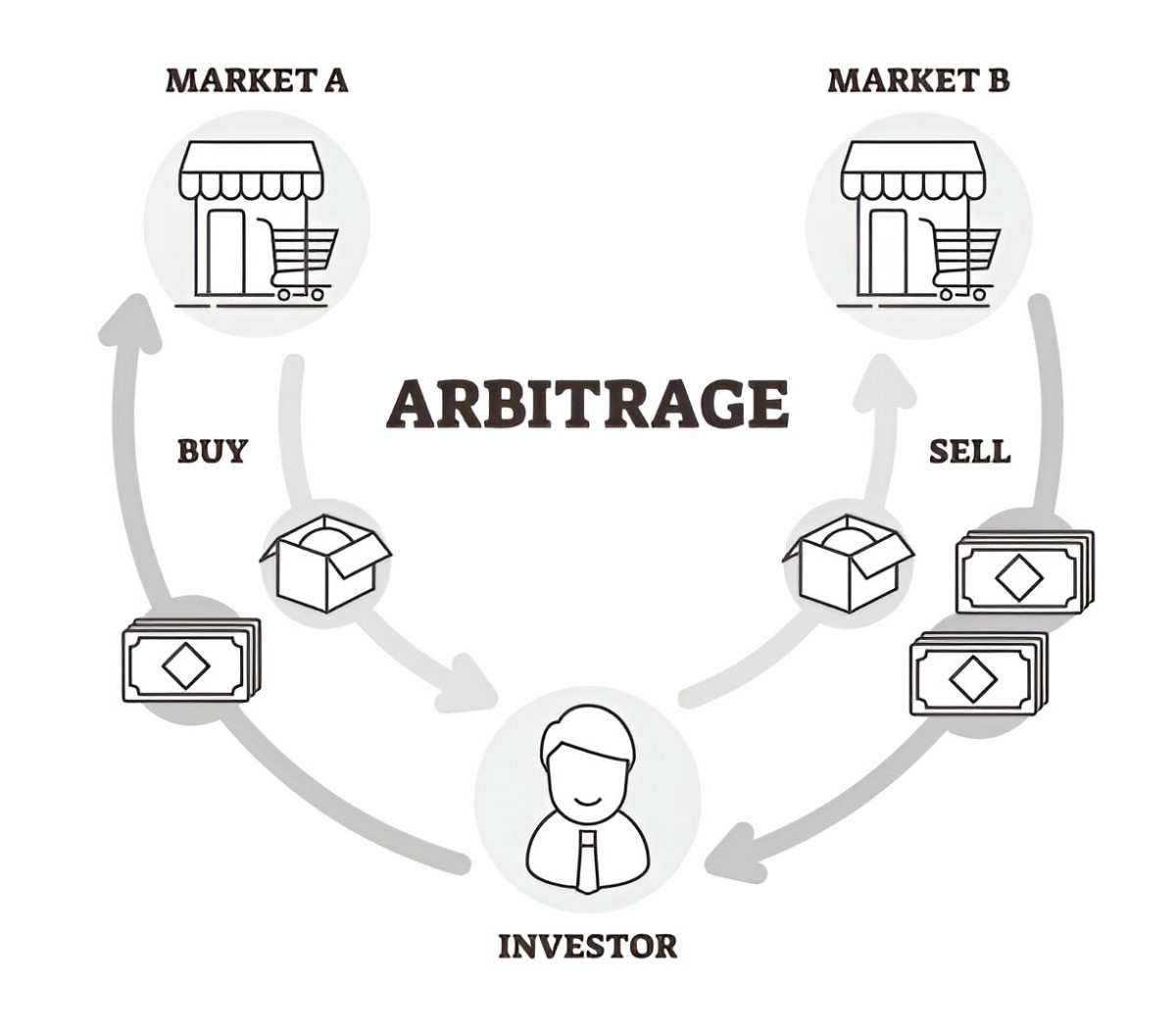

Arbitrage mutual funds exploit price differences between cash and derivatives markets. They buy stocks in the cash market and simultaneously sell equivalent futures or options, locking in small but risk-free profits. Since these funds rely on market inefficiencies, they perform best in volatile conditions.

How Arbitrage Works: A Simple Example

Suppose stock XYZ trades at $100 in the cash market but its one-month future trades at $102. An arbitrageur can:

- Buy XYZ at $100 in the cash market.

- Sell a one-month futures contract at $102.

- Hold until expiry, delivering the stock and earning $2 (minus transaction costs).

The profit here is:

Profit = Futures Price - Cash Price - Transaction CostsWhy Consider Arbitrage Funds?

1. Lower Risk Than Equity Funds

Since positions are hedged, market direction doesn’t impact returns.

2. Tax Efficiency

In the U.S., these funds are taxed as equity funds if they hold at least 80% equities, benefiting from long-term capital gains rates.

3. Liquidity

Most arbitrage funds allow daily redemptions, unlike hedge funds with lock-in periods.

Performance and Returns

Arbitrage funds don’t promise high returns. Historically, they yield 4-6\% annually—better than savings accounts but lower than pure equity funds.

Comparison Table: Arbitrage Funds vs. Other Short-Term Investments

| Feature | Arbitrage Funds | Money Market Funds | Short-Term Bond Funds |

|---|---|---|---|

| Risk Level | Low to Moderate | Very Low | Moderate |

| Returns (Annual) | 4-6% | 2-3% | 3-5% |

| Liquidity | High | Very High | High |

| Tax Treatment | Equity Taxation* | Ordinary Income | Ordinary Income |

*If classified as equity-oriented.

Key Risks

1. Low Returns in Stable Markets

Arbitrage thrives on volatility. In calm markets, spreads shrink, reducing profits.

2. Expense Ratios

Since these funds trade frequently, costs can eat into thin margins.

3. Not Risk-Free

Execution risk exists—if trades don’t synchronize, losses may occur.

Who Should Invest?

- Conservative investors seeking equity-like taxation with lower risk.

- Parking short-term funds with better returns than savings accounts.

- Portfolio diversifiers to reduce overall volatility.

Final Thoughts

Arbitrage funds won’t make you rich, but they offer a smart way to earn modest returns with controlled risk. I recommend them for investors who want tax-efficient, low-volatility options without sacrificing liquidity.