In my practice, I often encounter investors who have been presented with a variable annuity as a solution for retirement planning. The conversation typically focuses on the tax-deferral and insurance benefits. But the true engine of a variable annuity’s long-term growth—the element that will ultimately determine its success or failure—is the selection of underlying investments, known as sub-accounts. For a provider like Fidelity, these sub-accounts are predominantly proprietary mutual funds. Understanding this menu of options is not a secondary consideration; it is the primary act of designing your investment within the annuity wrapper. Today, I will dissect the structure of Fidelity’s variable annuity offerings, analyze the mutual funds available within them, and provide a framework for building a rational, cost-aware strategy that aligns with your goals.

Table of Contents

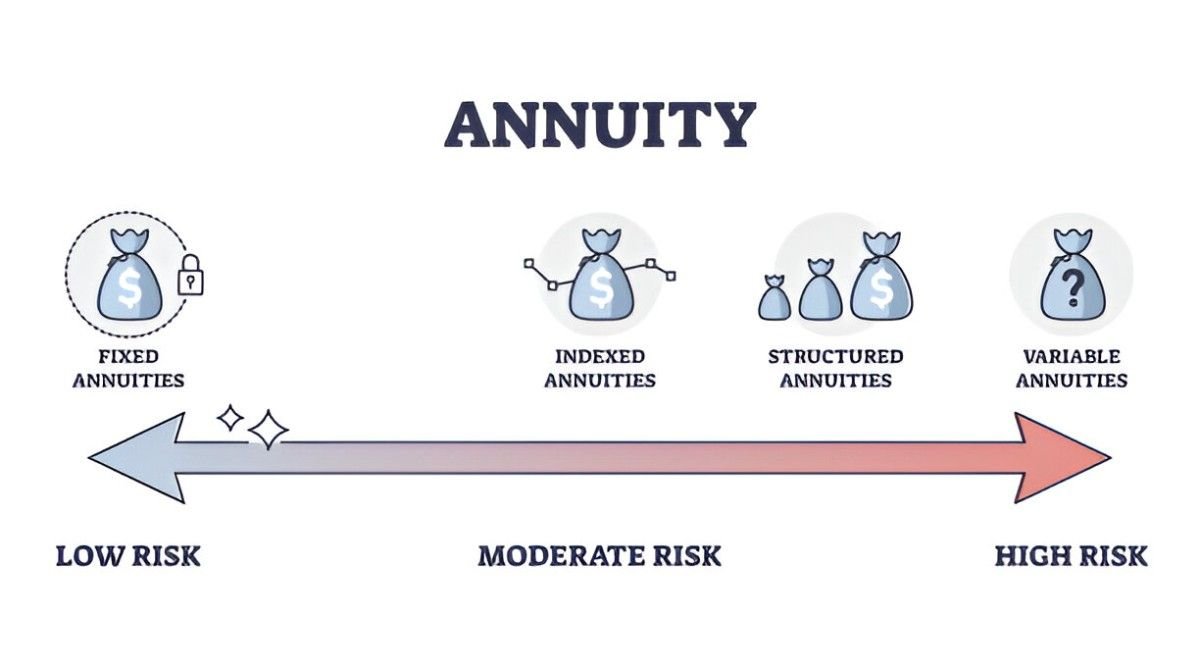

Demystifying the Structure: The Annuity Wrapper and the Investment Core

A variable annuity is a contract between you and an insurance company, in this case, Fidelity’s life insurance affiliate. It has two distinct components:

- The Insurance Wrapper: This is the contractual structure that provides the features unique to annuities: tax-deferred growth of earnings, a death benefit, and optional riders that can provide guaranteed lifetime income (for an additional cost).

- The Separate Account: This is the investment core. It is a segregated pool of assets held by the insurance company. When you allocate your premium to various sub-accounts, you are directing your money into this separate account to be invested in specific underlying portfolios.

These sub-accounts are, for all functional purposes, mutual funds. They have investment objectives, managers, and portfolios. However, they are exclusively available within the annuity contract and are typically clones or share classes of Fidelity’s retail mutual funds, often with slightly different ticker symbols and, crucially, different fee structures.

The Investment Universe: Categories of Available Funds

Fidelity’s variable annuities, such as the Fidelity Personal Retirement Annuity®, typically offer a wide array of sub-accounts designed to cater to every risk tolerance and investment style. The menu is usually organized into the following categories:

- Fidelity Funds: The core of the offering. This includes their renowned actively managed funds and index funds.

- Non-Fidelity Funds: A selection of sub-accounts from other premier fund families (e.g., American Funds, PIMCO, T. Rowe Price). This provides diversification of management style.

- Asset Allocation Portfolios: These are pre-mixed portfolios, such as target-risk funds (Conservative, Moderate, Growth) or target-date retirement funds. They offer a “one-stop-shop” solution.

- Fixed Account: A capital preservation option that pays a declared interest rate, functioning like a bond within the annuity.

- Stable Value Account: A low-risk option that aims to preserve principal and provide a stable, albeit modest, return.

A Critical Analysis of the “Fidelity Funds” Lineup

The most important section for a savvy investor is the list of proprietary Fidelity funds. This lineup is typically a “greatest hits” collection, but it requires careful scrutiny. Let’s break down the common offerings you will find:

1. Equity Sub-Accounts:

- Active Growth: Funds like those mirroring Fidelity Contrafund or Fidelity Growth Company. These are flagship funds with long histories and strong managers, but they carry higher expense ratios.

- Active Value: Funds following a value-oriented strategy.

- Index Funds: This is where cost-conscious investors should focus. You will typically find options that track the S&P 500 (e.g., Fidelity VIP Index 500), the total stock market, developed international markets, and emerging markets. These are the most efficient building blocks.

2. Fixed Income Sub-Accounts:

- Active Bond Funds: Managed funds like those mirroring Fidelity Total Bond or Fidelity High Income.

- Bond Index Funds: Options tracking the Bloomberg U.S. Aggregate Bond Index, offering low-cost, broad exposure to the investment-grade bond market.

3. Specialty and Sector Sub-Accounts:

- These include real estate, technology, or healthcare sector funds. These are tactical tools and should be used sparingly, if at all, within a core annuity portfolio due to their higher risk and cost.

The Decisive Factor: Analyzing the Cost Structure

This is the most critical part of the analysis. The expense of a variable annuity has two layers:

- The Mortality and Expense (M&E) Risk Charge: This is the cost of the insurance wrapper. It pays for the death benefit, administrative costs, and the insurance company’s profit. This fee is typically between 0.90% and 1.40% annually.

- The Sub-Account Expense Ratio: This is the fee for the underlying mutual fund management.

Your total annual expense is the sum of these two layers.

Let’s illustrate the impact with a calculation. Assume you invest \text{\$100,000}.

- Scenario A: Low-Cost Index Sub-Account

- M&E Fee: 1.10%

- Sub-Account Fee (S&P 500 Index): 0.30%

- Total Annual Fee: 1.40%

- Scenario B: Active Growth Sub-Account

- M&E Fee: 1.10%

- Sub-Account Fee (Active Growth Fund): 0.85%

- Total Annual Fee: 1.95%

The difference of 0.55% per year seems small, but let’s see the impact over 20 years, assuming a 7% gross annual return.

Scenario A Future Value:

\text{FV} = \text{\$100,000} \times (1 + (0.07 - 0.014))^{20} = \text{\$100,000} \times (1.056)^{20} \approx \text{\$298,000}Scenario B Future Value:

\text{FV} = \text{\$100,000} \times (1 + (0.07 - 0.0195))^{20} = \text{\$100,000} \times (1.0505)^{20} \approx \text{\$268,000}Cost of Higher Fees: \text{\$298,000} - \text{\$268,000} = \text{\$30,000}

The higher-cost active fund option would cost you \text{\$30,000} in potential earnings over two decades, purely due to fees. This demonstrates why your primary focus within the annuity should be on the lowest-cost sub-account options available.

Table: Cost Comparison of Hypothetical Fidelity Variable Annuity Sub-Accounts

| Sub-Account Type | M&E Fee | Sub-Account ER | Total Fee | Cost on $100k/yr |

|---|---|---|---|---|

| S&P 500 Index | 1.10% | 0.30% | 1.40% | $1,400 |

| Active Growth Fund | 1.10% | 0.85% | 1.95% | $1,950 |

| Active Bond Fund | 1.10% | 0.65% | 1.75% | $1,750 |

Strategic Allocation: Building a Portfolio Within the Annuity

Given the cost burden of the wrapper, your investment strategy inside the annuity should be deliberate.

- Use Low-Cost Index Funds as Core Holdings: Build the foundation of your allocation using the cheapest available index funds for U.S. equity, international equity, and U.S. bonds.

- Use Tax-Inefficient Assets: Variable annuities are tax-inefficient themselves (all growth is taxed as ordinary income upon withdrawal). Therefore, it makes little sense to hold tax-inefficient assets like bonds or REITs outside of an annuity. The annuity wrapper can be an appropriate place for these holdings, as the tax deferral is beneficial for the high income they generate.

- Avoid Redundancy: Do not use the annuity for investments that are already tax-efficient, like broad-market stock index funds, especially if you hold them in taxable accounts where they benefit from lower long-term capital gains rates.

My Final Counsel: A Tool for a Specific Purpose

Fidelity’s variable annuities offer a powerful menu of mutual funds, but the vehicle itself is complex and expensive. It is not suitable for everyone.

A variable annuity is appropriate only if:

- You are already maximizing contributions to all other tax-advantaged accounts (401(k), IRA).

- You are in a high tax bracket and need additional tax-deferred space for bonds or other income-producing assets.

- You have a specific need for the lifetime income guarantees offered by optional riders (understanding you will pay extra for them).

- You are committed to using the lowest-cost sub-accounts to minimize the drag of fees.

Before investing, you must perform a simple cost-benefit analysis: Do the benefits of tax deferral and insurance guarantees outweigh the total annual cost of 1.40% to 2.00% for decades?

For most investors, the answer is no. The same low-cost Fidelity index funds are available in a standard taxable brokerage account, where they will be far more tax-efficient. However, for a specific subset of high-net-worth, high-income investors with fully funded other accounts, the Fidelity variable annuity—when constructed carefully with its most efficient building blocks—can serve as a rational component of a comprehensive retirement plan. Your job is to look past the insurance sales pitch and architect the investment core with the precision it demands.