As an investor navigating the world of collective investment schemes, I often encounter the terms “unit trusts” and “mutual funds.” While these investment vehicles share similarities, they also possess distinct characteristics that can influence my investment decisions. In this comprehensive article, I delve into the nuances of unit trusts and mutual funds, exploring their structures, management styles, fee structures, and tax implications, among other factors.

Table of Contents

Understanding the Basics

Unit Trusts

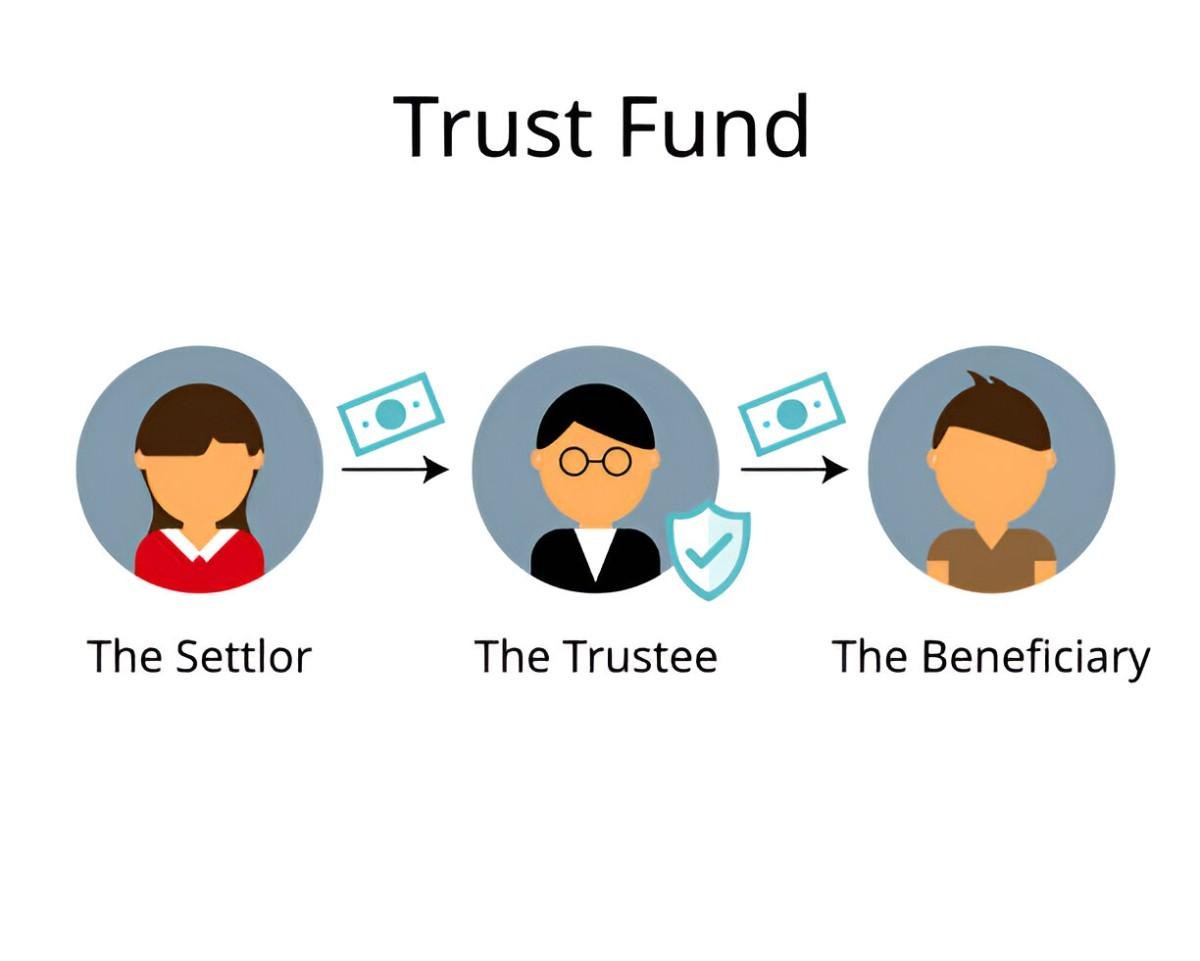

A unit trust is a type of collective investment scheme established under a trust deed. In this structure, a trustee holds the assets on behalf of the investors, who are the beneficiaries. The fund is typically open-ended, meaning that new units can be created or existing units can be redeemed based on investor demand.

Mutual Funds

Mutual funds, prevalent in the United States, are also collective investment schemes that pool money from multiple investors to invest in a diversified portfolio of securities. They are managed by professional fund managers and are subject to regulations set by the Securities and Exchange Commission (SEC).

Structural Differences

| Feature | Unit Trusts | Mutual Funds |

|---|---|---|

| Legal Structure | Established under a trust deed | Incorporated as a company |

| Management Style | Can be actively or passively managed | Typically actively managed |

| Redemption Process | Units redeemed at the Net Asset Value (NAV) | Shares redeemed at NAV |

| Regulatory Body | Varies by jurisdiction | Regulated by the SEC in the U.S. |

Source: Investopedia

Investment Strategies

Unit Trusts

Unit trusts can employ various investment strategies, including:

- Active Management: Fund managers make investment decisions based on research and analysis.

- Passive Management: The fund aims to replicate the performance of a specific index.

Mutual Funds

Mutual funds in the U.S. predominantly follow an active management approach, where fund managers select securities based on their research and market outlook.

Fee Structures

The fee structures of unit trusts and mutual funds can vary, but common fees include:

- Management Fees: Charged by the fund manager for managing the portfolio.

- Sales Charges (Loads): Fees paid when buying or selling units or shares.

- Custodian Fees: Fees for safekeeping the fund’s assets.

It’s essential to review the fund’s prospectus to understand the specific fees associated with each investment.

Tax Implications

Both unit trusts and mutual funds are subject to taxation on income and capital gains. However, the tax treatment can differ based on the investor’s jurisdiction and the fund’s structure. In the U.S., mutual funds are required to distribute at least 90% of their taxable income to shareholders, who then report this income on their tax returns.

Liquidity and Trading

- Unit Trusts: Units are typically bought and sold at the NAV, which is calculated at the end of each trading day.

- Mutual Funds: Shares are also bought and sold at the NAV, but some funds may offer features like automatic investment plans or systematic withdrawal plans.

Risk Considerations

Both investment vehicles carry risks, including:

- Market Risk: The value of investments can fluctuate based on market conditions.

- Manager Risk: The performance of the fund depends on the decisions made by the fund manager.

- Liquidity Risk: The ability to buy or sell units or shares may be affected by market conditions.

Example Calculation

Suppose I invest $10,000 in a mutual fund with an annual management fee of 1.5%. Over one year, the fund’s value increases by 8%. The management fee would be:

The net return after the fee would be:

Therefore, my investment would grow by $650 over the year, excluding other potential fees or taxes.

Conclusion

While unit trusts and mutual funds share the common goal of pooling investor funds to achieve diversification, they differ in their structures, management styles, and regulatory environments. Understanding these differences allows me to make informed decisions aligned with my investment objectives and risk tolerance. It’s crucial to consult with a financial advisor and thoroughly review the fund’s prospectus before making any investment decisions.