When I started investing in mutual funds, I quickly realized that not all share classes are created equal. One of the most important decisions I make before buying into a mutual fund is choosing the right share class—especially when it comes to A shares and B shares. These two types can significantly impact what I pay, how long I stay invested, and what I ultimately earn. In this article, I’ll walk through what A and B shares really are, how they differ, and how I decide between them based on fees, timelines, and my financial goals.

Table of Contents

Understanding Mutual Fund Share Classes

When I invest in a mutual fund, I’m essentially buying shares in a pool of professionally managed assets. Mutual fund companies offer different share classes to give investors like me choices in how we pay for access. The underlying portfolio stays the same, but the cost structure varies. A shares and B shares are both load funds, meaning I may pay a sales charge either up front or when I sell.

Here’s the general breakdown:

| Share Class | When Fees Are Paid | Common Uses |

|---|---|---|

| A Shares | Front-end load (at purchase) | Long-term investments |

| B Shares | Back-end load (at redemption) | Medium-term investing |

What Are A Shares?

A shares typically charge a front-end load, which means I pay a percentage of my investment upfront. This fee goes to the broker or advisor who sold me the fund. For example, if the front-end load is 5.75% and I invest $10,000, the actual amount invested is:

\text{Net Investment} = 10000 \times (1 - 0.0575) = 9425That means $575 goes toward the sales commission, and only $9,425 is invested into the fund. Although this feels like a hit at the beginning, A shares usually come with lower ongoing expenses than B shares, especially the 12b-1 marketing fee. So if I plan to hold the investment for a long time, the upfront cost might be offset by the lower annual fees.

Typical characteristics of A shares:

- Front-end sales charge (commonly 3%–5.75%)

- Lower 12b-1 fees (often 0.25%)

- Best suited for long-term investors

Some funds offer breakpoints—discounted sales charges for larger investments. For example, investing $50,000 or more might reduce my front-end load to 4.5% or lower. Here’s how breakpoints might work:

| Investment Amount | Front-End Load |

|---|---|

| Less than $25,000 | 5.75% |

| $25,000–$49,999 | 5.00% |

| $50,000–$99,999 | 4.50% |

| $100,000+ | 0%–3.00% |

That’s one reason I might consider investing a larger lump sum all at once in A shares.

What Are B Shares?

B shares defer the sales charge until I redeem the investment. This is called a contingent deferred sales charge (CDSC). The longer I hold the investment, the smaller the back-end fee becomes. Typically, the fee drops to zero after six years.

For example, if I sell in the first year, I might pay a 5% fee. In the second year, 4%, and so on until year six or seven when it disappears.

CDSC schedule might look like this:

| Year of Redemption | Back-End Load |

|---|---|

| 1 | 5.00% |

| 2 | 4.00% |

| 3 | 3.00% |

| 4 | 2.00% |

| 5 | 1.00% |

| 6+ | 0.00% |

Unlike A shares, B shares don’t reduce my initial investment. My full $10,000 gets invested immediately. But B shares often carry higher 12b-1 fees, usually around 1%. That higher annual fee adds up over time.

Typical features of B shares:

- No front-end load

- Deferred sales charge if sold early

- Higher ongoing expenses

- Often convert to A shares after 6–8 years

So B shares might look better at first glance, especially if I don’t want to pay anything upfront. But over time, the higher annual expenses could cost me more than the front-end fee of A shares.

How I Compare A Shares vs. B Shares Over Time

Let’s say I’m investing $10,000 into a mutual fund with an assumed 7% annual return. Let’s also assume the following:

- A share front-end load: 5.75%

- A share 12b-1 fee: 0.25%

- B share 12b-1 fee: 1.00%

- No redemption before 6 years

Year 1 Net Investment (A Shares):

\text{Net A Investment} = 10000 \times (1 - 0.0575) = 9425Year 1 Value (A Shares):

9425 \times (1 + 0.07 - 0.0025) = 10080.62Year 1 Value (B Shares):

10000 \times (1 + 0.07 - 0.01) = 10600B shares start ahead because the full amount is invested. But let’s fast forward 10 years and see how they compare.

Year 10 Value (A Shares):

9425 \times (1 + 0.0675)^{10} \approx 17856.35Year 10 Value (B Shares):

10000 \times (1 + 0.06)^{10} \approx 17908.48Even after 10 years, B shares still slightly outperform. But that’s under ideal conditions. In practice, many funds convert B shares into A shares after 6–8 years, adjusting fee structures and resetting 12b-1 fees to A-share levels.

So in some cases, the difference may become negligible after long holding periods. But if I plan to sell early—within 4 or 5 years—A shares may be a poor choice due to the upfront cost.

When I Prefer A Shares

I go with A shares when:

- I’m investing a large amount (qualifying for breakpoints)

- I plan to hold the investment for 7+ years

- I value lower ongoing expenses

When I Prefer B Shares

I consider B shares when:

- I don’t qualify for breakpoint discounts

- I want my full investment working immediately

- I plan to hold for at least 6 years but want flexibility

- I can manage the higher annual expenses

Other Share Classes I Consider

- C Shares: No front-end or back-end load, but the highest 12b-1 fees (~1%). Best for short-term holding (under 3 years)

- No-Load Shares: No sales charges or 12b-1 fees; available in many online brokerages or directly from fund companies

| Feature | A Shares | B Shares | C Shares | No-Load Funds |

|---|---|---|---|---|

| Front-End Load | Yes (3–5.75%) | No | No | No |

| Back-End Load | No | Yes (5–0%, declining) | Sometimes (1%) | No |

| Ongoing 12b-1 Fee | Low (0.25%) | High (1%) | High (1%) | None |

| Converts to A Shares | Not Applicable | Yes (after ~6–8 yrs) | No | Not Applicable |

| Best for | Long-term | Medium-term | Short-term | All terms (if available) |

The Bottom Line

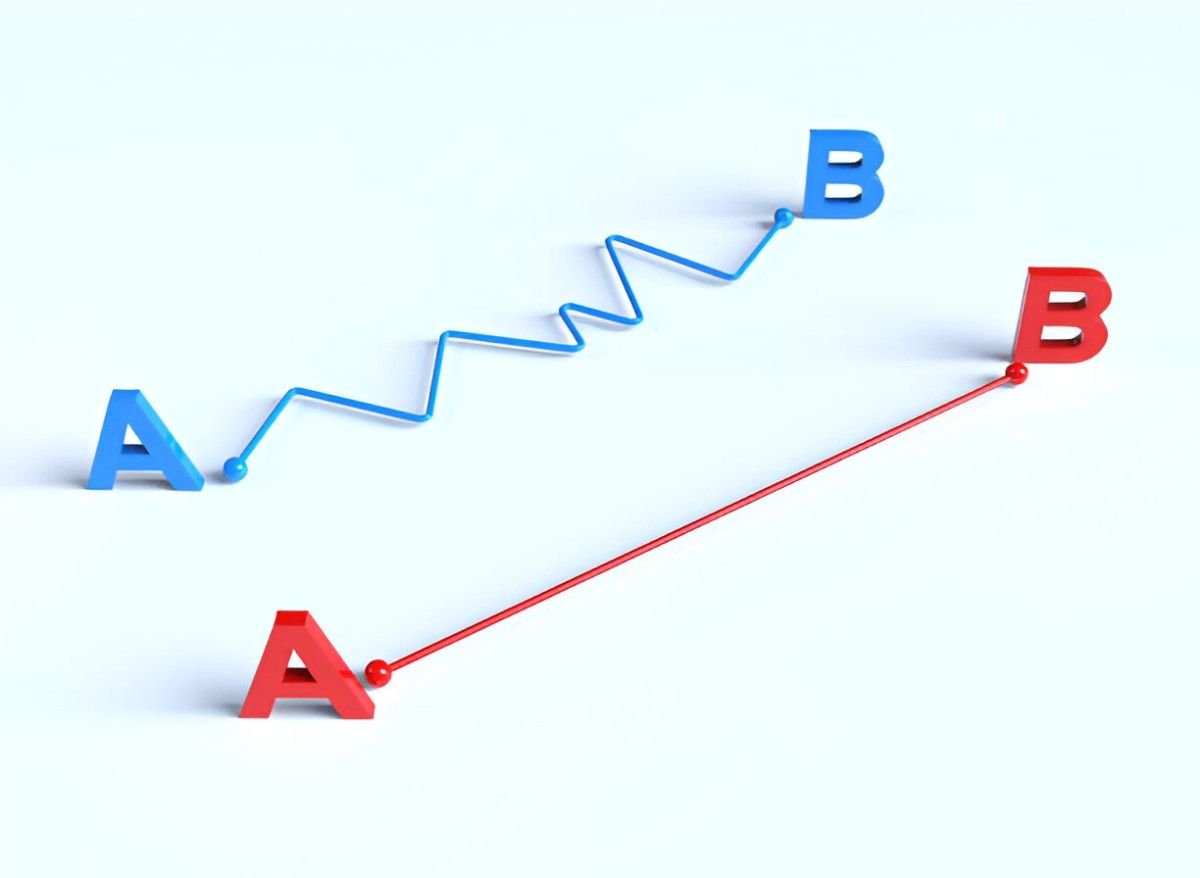

Choosing between A shares and B shares isn’t just about numbers—it’s about my investing style, timeline, and comfort with fees. I treat the front-end load of A shares as a tradeoff for lower expenses down the road. I treat B shares as a back-loaded option that rewards patience but penalizes early exits.

Here’s what I ask myself before deciding:

- How long do I plan to stay invested?

- Can I invest enough to qualify for breakpoints?

- Do I want to avoid upfront costs?

- Am I okay with higher fees each year?

Each answer points me toward the better share class for my needs. If I plan carefully and stay invested with discipline, either class can serve me well. But ignoring the fee structure? That can quietly erode what I’ve worked hard to earn.