As someone who has analyzed financial trends for years, I notice patterns that define business success. One such pattern is hockey-stick growth—a sudden, sharp rise in revenue or user acquisition after a period of stagnation. The term comes from the shape of a hockey stick: flat at first, then curving upward steeply. But what drives this phenomenon? Is it sustainable? And how can businesses harness it without collapsing under its weight?

Table of Contents

The Anatomy of Hockey-Stick Growth

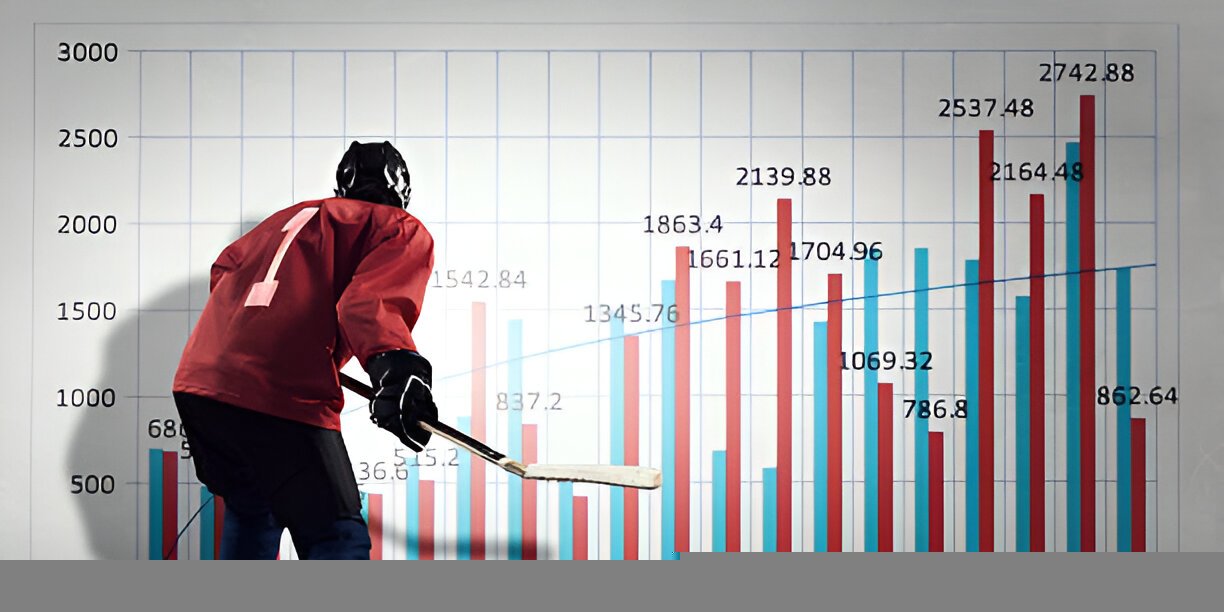

Hockey-stick growth follows a distinct trajectory. Early stages show slow progress, often due to market testing, product refinement, or limited initial demand. Then, a tipping point hits—customer adoption accelerates, revenue spikes, and the business scales rapidly.

Mathematically, this can be modeled using exponential growth functions. If y(t) represents revenue at time t, the growth phase can be expressed as:

y(t) = y_0 \cdot e^{kt}Here, y_0 is initial revenue, k is the growth rate, and e is Euler’s number. The curve remains flat when k is small but surges as k increases.

Key Drivers of Rapid Expansion

Several factors contribute to hockey-stick growth:

- Network Effects – Platforms like Facebook or Uber grow exponentially because each new user adds value for others.

- Viral Adoption – Products with built-in sharing mechanisms (e.g., Dropbox’s referral program) spread faster.

- Economies of Scale – Lower per-unit costs at higher production volumes boost margins.

- Regulatory or Market Shifts – Policy changes (e.g., renewable energy subsidies) can trigger sudden demand.

Case Study: Tesla’s Growth Trajectory

Tesla’s revenue from 2013 to 2023 illustrates hockey-stick growth. Early years saw modest sales, but after Model 3’s mass production, revenue skyrocketed:

| Year | Revenue (in billions) | Growth Rate (%) |

|---|---|---|

| 2013 | $2.01 | 5.2 |

| 2015 | $4.05 | 27.1 |

| 2018 | $21.46 | 82.5 |

| 2021 | $53.82 | 70.7 |

| 2023 | $96.77 | 51.4 |

The inflection point came when Tesla scaled production and reduced battery costs—proving that operational efficiency fuels exponential growth.

The Risks of Over-Optimism

While hockey-stick growth excites investors, it’s fraught with risks:

- Cash Flow Crunch – Scaling requires capital. If revenue lags behind expenses, liquidity dries up.

- Operational Strain – Rapid hiring or supply chain expansion can lead to quality control failures.

- Market Saturation – Growth slows once early adopters are exhausted.

Calculating the Sustainability of Growth

To assess whether growth is sustainable, I use the Rule of 40—a metric balancing growth rate and profitability:

\text{Growth Rate} + \text{Profit Margin} \geq 40\%For example, if a SaaS company grows at 60% but has a -25% profit margin, its score is 35 (<40), signaling instability.

Strategic Levers to Sustain Growth

Businesses aiming for long-term success must balance speed with stability. Here’s how:

1. Gradual Scaling

Instead of overextending, phase expansions. Amazon’s methodical rollout of AWS services ensured reliability despite demand surges.

2. Customer Retention Focus

Acquiring customers is costly. Increasing retention by 5% can boost profits by 25–95% (Bain & Company).

3. Data-Driven Forecasting

Predictive models help anticipate demand. A simple linear regression:

y = \beta_0 + \beta_1 x + \epsilonwhere y is sales and x is time, can reveal trends before they become crises.

The Role of External Factors

US market dynamics heavily influence hockey-stick growth:

- Venture Capital Availability – Startups in Silicon Valley secure funding faster than in other regions.

- Regulatory Environment – GDPR compliance costs slowed European tech growth compared to the US.

- Consumer Behavior – American consumers adopt new tech faster, fueling rapid scalability.

Example: The Rise of Zoom

Zoom’s revenue jumped from $622M in 2019 to $2.65B in 2021—a 326% increase—due to remote work demand. However, post-pandemic growth normalized, proving that external shocks can’t sustain long-term curves.

Conclusion: Navigating the Hockey Stick

Hockey-stick growth is exhilarating but perilous. Businesses must prepare infrastructure, secure funding, and retain customers to avoid collapse. Mathematical models, strategic scaling, and market awareness separate fleeting spikes from enduring success.