In business and financial management, the breakeven point is a crucial concept that helps determine the minimum level of sales a company needs to cover its total costs and avoid losses. It is a fundamental tool for decision-making and financial planning.

Table of Contents

Definition and Purpose

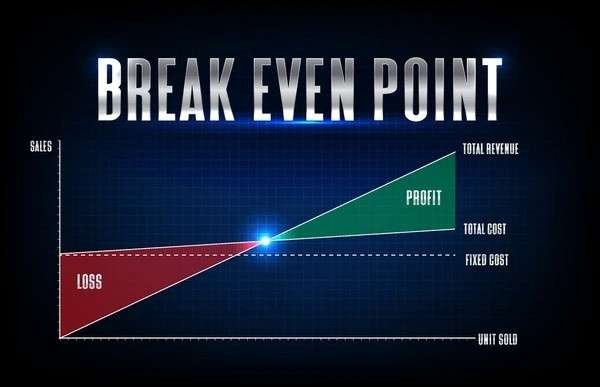

Definition: The breakeven point is the level of sales at which total revenue equals total costs, resulting in neither profit nor loss.

Purpose: The primary purpose of calculating the breakeven point is to understand the minimum sales volume required for a business to cover all its costs, both variable and fixed, thereby achieving a zero-profit scenario.

Key Components and Calculation

Components of Breakeven Point

- Fixed Costs: These are expenses that remain constant regardless of the level of production or sales. Examples include rent, salaries, and insurance premiums.

- Variable Costs: These costs vary with the level of production or sales. Examples include raw materials, direct labor, and sales commissions.

Breakeven Calculation

The breakeven point can be calculated using the following formula:

\text{Breakeven Point (units)} = \frac{\text{Fixed Costs}}{\text{Selling Price per Unit} - \text{Variable Cost per Unit}}Alternatively, it can be calculated in terms of sales revenue:

\text{Breakeven Point (sales revenue)} = \frac{\text{Fixed Costs}}{\text{Contribution Margin Ratio}} \text{Breakeven Point (sales revenue)} = \frac{\text{Fixed Costs}}{\text{Contribution Margin Ratio}} \text{Where Contribution Margin Ratio} \quad \left( = \frac{\text{Selling Price per Unit} - \text{Variable Cost per Unit}}{\text{Selling Price per Unit}} \right)Application and Examples

Practical Application

- Manufacturing: A manufacturing company uses the breakeven point to determine how many units of a product it needs to sell to cover all production costs.

- Retail: A retail store calculates its breakeven point to assess the sales volume needed to cover both fixed costs (like rent and utilities) and variable costs (like inventory and sales commissions).

Example Scenario

Consider a small bakery:

- Fixed Costs: Rent and utilities amount to $2,000 per month.

- Variable Costs: Ingredients and packaging cost $1 per cupcake.

- Selling Price: Each cupcake is sold for $3.

The bakery needs to sell 1,000 cupcakes to cover all costs and achieve a breakeven point.

Benefits and Importance

Benefits of Knowing the Breakeven Point

- Financial Planning: Helps businesses set realistic sales targets and pricing strategies to ensure profitability.

- Decision-Making: Guides decisions on production levels, pricing, and cost control measures.

Importance in Financial Management

- Profitability Analysis: Allows businesses to analyze the impact of changes in costs, prices, and sales volume on profitability.

- Risk Management: Helps in assessing financial risk and determining financial stability.

Factors Affecting the Breakeven Point

Key Factors

- Price Elasticity: Changes in selling price affect the breakeven point.

- Cost Structure: Variations in fixed and variable costs influence the breakeven analysis.

- Market Demand: Demand fluctuations impact sales volume required to reach the breakeven point.

Conclusion

The breakeven point is a critical metric in business and financial management, providing insights into the minimum sales volume or revenue needed for a business to cover all costs and achieve zero-profit. By understanding and calculating the breakeven point, businesses can make informed decisions regarding pricing, production levels, and cost management strategies. It serves as a fundamental tool for financial planning, profitability analysis, and risk management, enabling businesses to navigate competitive markets and sustain long-term growth. Mastery of the breakeven concept is essential for entrepreneurs, managers, and investors seeking to evaluate business performance and make sound financial decisions in dynamic economic environments.